Rising Biodiesel Production

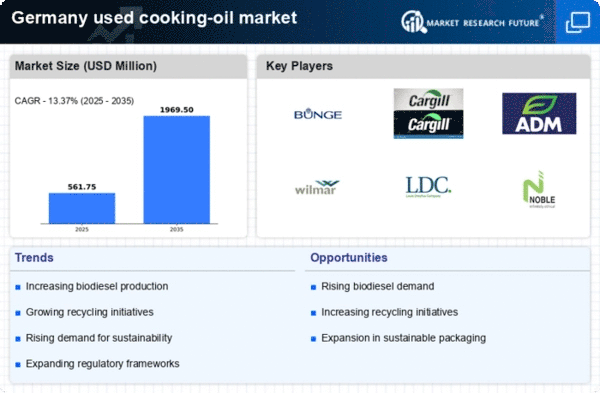

The increasing demand for biodiesel in Germany is a crucial driver for the used cooking-oil market. As the country aims to meet its renewable energy targets, the production of biodiesel from used cooking oil has gained momentum. In 2025, biodiesel production from waste oils is projected to account for approximately 20% of total biodiesel output. This shift not only supports energy diversification but also enhances the sustainability of fuel sources. The used cooking-oil market benefits from this trend, as more food establishments and households are encouraged to recycle their used oils. The economic incentives provided by the government further stimulate this market, creating a robust ecosystem for the collection and processing of used cooking oil into biodiesel.

Government Incentives for Recycling

Government incentives play a pivotal role in driving the used cooking-oil market in Germany. Various subsidies and tax breaks are offered to businesses and individuals who participate in recycling programs. These financial incentives encourage the collection and processing of used cooking oil, thereby increasing its availability for biodiesel production. In 2025, it is projected that government support will lead to a 25% rise in the volume of used cooking oil collected for recycling. This proactive approach not only bolsters the used cooking-oil market but also aligns with Germany's broader environmental goals, fostering a culture of sustainability and resource efficiency.

Increased Awareness of Waste Management

Growing awareness regarding waste management practices in Germany significantly influences the used cooking-oil market. As consumers and businesses become more conscious of their environmental impact, the proper disposal and recycling of used cooking oil have gained importance. Educational campaigns and community initiatives promote the benefits of recycling cooking oil, which can be transformed into biodiesel or other valuable products. This heightened awareness is reflected in a reported 15% increase in the collection of used cooking oil in urban areas. The used cooking-oil market is thus positioned to expand, as more individuals and organizations participate in sustainable waste management practices, contributing to a circular economy.

Shift Towards Circular Economy Practices

The transition towards circular economy practices in Germany is a significant driver for the used cooking-oil market. This approach emphasizes the importance of reusing and recycling materials to minimize waste and reduce environmental impact. As businesses and consumers increasingly adopt circular economy principles, the demand for recycled products, including biodiesel from used cooking oil, is expected to rise. In 2025, the used cooking-oil market is likely to experience a 20% growth as more stakeholders recognize the economic and environmental benefits of participating in a circular economy. This shift not only enhances resource efficiency but also promotes sustainable practices across various sectors.

Technological Advancements in Oil Processing

Technological innovations in the processing of used cooking oil are reshaping the market landscape in Germany. Advanced filtration and refining techniques have improved the quality of recycled oil, making it more suitable for biodiesel production and other applications. In 2025, it is estimated that the efficiency of processing plants has increased by 30%, leading to higher yields and lower operational costs. These advancements not only enhance the profitability of the used cooking-oil market but also attract investments in new processing facilities. As technology continues to evolve, the market is likely to see a surge in the adoption of more efficient and environmentally friendly processing methods.