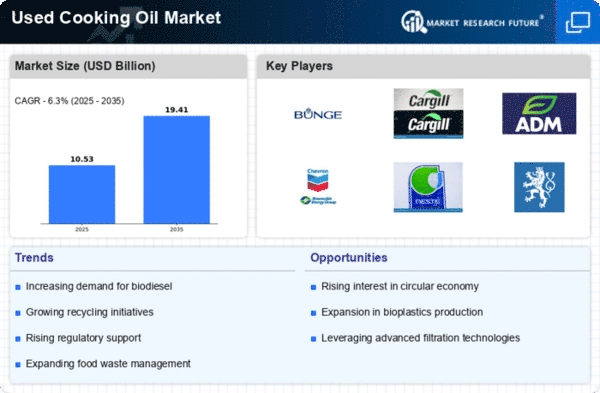

The Used Cooking Oil Market is currently characterized by a dynamic competitive landscape, driven by increasing demand for sustainable energy sources and the growing emphasis on waste-to-energy solutions. Key players such as Bunge Limited (US), Cargill, Incorporated (US), and Neste Corporation (FI) are strategically positioned to leverage their extensive supply chains and technological capabilities. Bunge Limited (US) focuses on enhancing its operational efficiency through digital transformation initiatives, while Cargill, Incorporated (US) emphasizes partnerships with local suppliers to optimize its sourcing strategies. Neste Corporation (FI) is heavily investing in R&D to innovate its processing technologies, which collectively shapes a competitive environment that is increasingly focused on sustainability and efficiency. In terms of business tactics, companies are localizing manufacturing to reduce transportation costs and enhance supply chain resilience. The market appears moderately fragmented, with a mix of large corporations and smaller players vying for market share. The collective influence of these key players is significant, as they drive industry standards and best practices, particularly in sustainability and operational excellence. In November 2025, Bunge Limited (US) announced a partnership with a leading technology firm to develop advanced analytics for optimizing its used cooking oil processing operations. This strategic move is likely to enhance Bunge's operational efficiency and reduce waste, aligning with the growing trend towards data-driven decision-making in the industry. Such initiatives may position Bunge as a leader in the sustainable oils segment, potentially increasing its market share. In October 2025, Cargill, Incorporated (US) expanded its used cooking oil collection network by acquiring a regional player specializing in waste oil management. This acquisition is strategically important as it not only broadens Cargill's operational footprint but also strengthens its supply chain, ensuring a more reliable source of feedstock for biodiesel production. This move reflects Cargill's commitment to enhancing its sustainability profile while addressing the increasing demand for renewable energy sources. In September 2025, Neste Corporation (FI) launched a new initiative aimed at increasing the efficiency of its used cooking oil processing facilities through automation and AI integration. This initiative is indicative of Neste's forward-thinking approach, as it seeks to reduce operational costs and improve product quality. By embracing cutting-edge technologies, Neste is likely to maintain its competitive edge in the market, appealing to environmentally conscious consumers and businesses alike. As of December 2025, the competitive trends in the Used Cooking Oil Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing supply chain reliability. The shift from price-based competition to a focus on technological advancement and sustainable practices is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market demands.