Rising Consumer Expectations

The product configurator market in Germany is experiencing a notable shift as consumer expectations continue to rise. Customers increasingly demand personalized products that cater to their specific needs and preferences. This trend is evident in various sectors, including automotive and consumer electronics, where customization options are becoming a standard offering. According to recent data, approximately 70% of consumers in Germany express a preference for brands that provide tailored solutions. This growing inclination towards personalization is driving companies to invest in product configurators, enabling them to meet these expectations effectively. As a result, businesses that adopt advanced configurator solutions are likely to enhance customer satisfaction and loyalty, thereby gaining a competitive edge in the product configurator market.

Growth of Online Retail Platforms

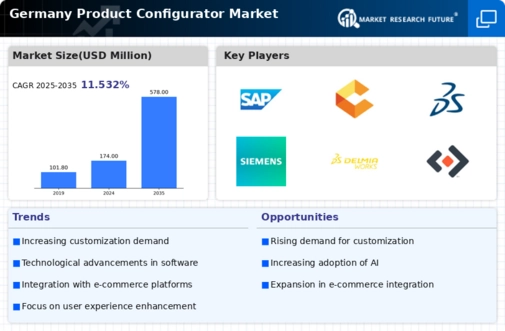

The expansion of online retail platforms is reshaping the product configurator market in Germany. As e-commerce continues to grow, businesses are recognizing the importance of providing online configurators to enhance the shopping experience. Data indicates that online retail sales in Germany have surged, with a growth rate of approximately 15% annually. This shift towards digital shopping necessitates the integration of product configurators that allow consumers to visualize and customize products before purchase. Consequently, companies that invest in robust online configurator solutions are likely to capture a larger share of the market, as they cater to the evolving preferences of tech-savvy consumers. The product configurator market is thus poised for significant growth as more retailers embrace this digital transformation.

Regulatory Support for Customization

Regulatory support for customization initiatives is emerging as a key driver in the product configurator market in Germany. Government policies aimed at promoting innovation and competitiveness are encouraging manufacturers to adopt customizable solutions. Initiatives that support research and development in advanced manufacturing technologies are particularly relevant. For instance, funding programs aimed at enhancing digitalization in manufacturing are likely to facilitate the adoption of product configurators. This regulatory environment fosters an ecosystem where businesses can invest in customization technologies with reduced financial risk. Consequently, the product configurator market is expected to benefit from this supportive framework, as companies leverage these opportunities to enhance their configurator capabilities and meet consumer demands.

Increased Competition Among Manufacturers

The product configurator market in Germany is witnessing intensified competition among manufacturers. As more companies recognize the value of offering customizable products, the market is becoming increasingly saturated. This competitive landscape compels businesses to differentiate themselves through innovative configurator solutions. Companies are investing in advanced features such as real-time rendering and user-friendly interfaces to attract customers. Furthermore, the rise of niche players specializing in specific product categories is contributing to this competitive environment. As a result, established manufacturers must continuously enhance their configurator offerings to maintain market share. This dynamic is likely to drive innovation and improvements within the product configurator market, ultimately benefiting consumers through a wider array of choices.

Technological Advancements in Manufacturing

Technological advancements are significantly influencing the product configurator market in Germany. Innovations such as 3D printing, artificial intelligence, and augmented reality are transforming how products are designed and manufactured. These technologies allow for greater flexibility and efficiency in production processes, enabling companies to offer highly customizable products without incurring substantial costs. For instance, the integration of AI in product configurators can streamline the design process, reducing lead times and improving accuracy. As a result, manufacturers are increasingly adopting these technologies to enhance their configurator capabilities, which is expected to drive growth in the product configurator market. The potential for reduced production costs and improved product quality further incentivizes this trend.