Government Policy and Incentives

The onshore wind-energy market in Germany is significantly influenced by government policies and incentives aimed at promoting renewable energy. The Renewable Energy Sources Act (EEG) provides a framework for feed-in tariffs and market premiums, which ensure stable revenue streams for wind energy producers. In 2025, the government is expected to enhance these incentives to meet its climate goals, potentially increasing the share of wind energy in the national energy mix to 50% by 2030. Such policies not only encourage the development of new projects but also facilitate the repowering of existing wind farms, thereby optimizing energy production. The alignment of government objectives with market needs appears to be a crucial driver for the growth of the onshore wind-energy market.

Investment in Renewable Infrastructure

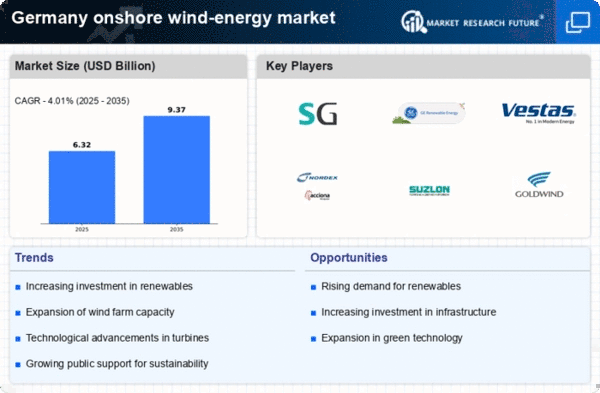

The onshore wind-energy market in Germany is experiencing a surge in investment, driven by both public and private sectors. In 2025, investments in renewable energy infrastructure are projected to exceed €30 billion, reflecting a robust commitment to sustainable energy sources. This influx of capital is likely to enhance the development of wind farms, thereby increasing the overall capacity of onshore wind energy. Furthermore, the German government has set ambitious targets to achieve 65% of its electricity generation from renewable sources by 2030, which further incentivizes investment in the onshore wind-energy market. The financial backing from various stakeholders, including institutional investors and energy companies, appears to be a critical driver in expanding the market's infrastructure and operational capabilities.

Community Engagement and Local Benefits

Community engagement is emerging as a vital driver in the onshore wind-energy market in Germany. Projects that actively involve local communities tend to gain greater acceptance and support, which is essential for successful implementation. In 2025, it is anticipated that more than 40% of new wind projects will incorporate community ownership models, allowing residents to benefit directly from local energy production. This approach not only fosters goodwill but also enhances the economic viability of projects by ensuring local stakeholders have a vested interest in their success. The emphasis on community benefits, such as job creation and local investment, appears to be a key factor in driving the expansion of the onshore wind-energy market, as it aligns the interests of developers with those of the communities they serve.

Technological Innovations in Turbine Design

Innovations in turbine technology are playing a pivotal role in the onshore wind-energy market. The introduction of larger and more efficient turbines has the potential to significantly increase energy output while reducing the cost per megawatt-hour. In 2025, the average capacity of newly installed turbines in Germany is expected to reach 3.5 MW, compared to 2.5 MW in previous years. This advancement not only enhances the efficiency of energy production but also contributes to lowering the levelized cost of energy (LCOE), making onshore wind more competitive against fossil fuels. As manufacturers continue to invest in research and development, the onshore wind-energy market is likely to benefit from improved performance and reliability, which could attract further investments and support from stakeholders.

Rising Energy Demand and Sustainability Goals

The increasing demand for energy in Germany, coupled with stringent sustainability goals, is propelling the onshore wind-energy market forward. As the country transitions towards a low-carbon economy, the need for renewable energy sources is becoming more pronounced. Projections indicate that energy consumption in Germany could rise by 10% by 2030, necessitating a substantial increase in renewable energy generation. The onshore wind-energy market is well-positioned to meet this demand, as it offers a reliable and sustainable energy source. Additionally, the commitment to reducing greenhouse gas emissions by 55% by 2030 further underscores the importance of wind energy in achieving these targets. This growing alignment between energy demand and sustainability objectives is likely to drive investments and development in the onshore wind-energy market.