Shift Towards Value-Based Care

The transition from volume-based to value-based care in Germany is significantly influencing the medical coding market. This paradigm shift emphasizes the quality of care provided rather than the quantity of services rendered. As healthcare providers adapt to this model, there is an increasing need for precise coding to reflect the quality of care delivered. Accurate medical coding is essential for reimbursement under value-based care models, which often rely on performance metrics. This shift is likely to drive investments in coding technologies and training, as providers seek to align their coding practices with the new reimbursement structures. The medical coding market must evolve to support this transition. This ensures that healthcare providers can effectively document and report the quality of care they deliver.

Growing Need for Skilled Coders

The medical coding market in Germany is facing a growing need for skilled coders. This need is driven by the increasing complexity of healthcare billing and coding requirements. As the healthcare landscape evolves, coders must possess a deep understanding of medical terminology, coding systems, and regulatory guidelines. The demand for certified medical coders is expected to rise, as healthcare organizations prioritize accuracy and compliance in their coding practices. This trend may lead to an increase in educational programs and certification courses aimed at equipping individuals with the necessary skills. The medical coding market must adapt to this demand for skilled professionals, ensuring that the workforce is adequately trained to meet the evolving needs of the healthcare sector.

Increased Focus on Data Security

With the rise of digital health records and telemedicine, the medical coding market in Germany faces heightened scrutiny regarding data security and patient privacy. The implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), necessitates that healthcare organizations adopt robust coding practices that safeguard sensitive patient information. As a result, there is a growing demand for coding solutions that incorporate advanced security features to protect against data breaches. This focus on data security not only impacts the operational aspects of the medical coding market but also influences the selection of coding software and training programs. Organizations are likely to invest in secure coding solutions to ensure compliance with legal requirements and maintain patient trust.

Rising Demand for Healthcare Services

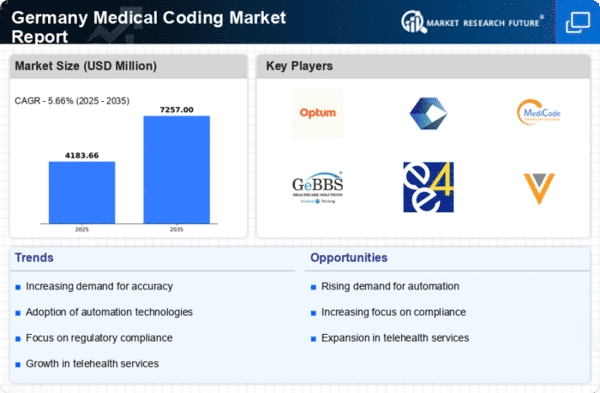

The medical coding market in Germany is experiencing a notable surge in demand. This demand is driven by an increasing population and a growing prevalence of chronic diseases. As the healthcare sector expands, the need for accurate and efficient medical coding becomes paramount. This demand is reflected in the projected growth of the healthcare expenditure, which is expected to reach approximately €500 billion by 2025. Consequently, healthcare providers are investing in advanced coding solutions to enhance operational efficiency and ensure compliance with billing regulations. The rising demand for healthcare services necessitates a robust medical coding market to support the accurate documentation and billing of services rendered, thereby facilitating smoother financial transactions within the healthcare ecosystem.

Technological Advancements in Coding Software

The medical coding market in Germany is being propelled by rapid technological advancements. These advancements are occurring in coding software. Innovations such as artificial intelligence (AI) and machine learning are enhancing the accuracy and efficiency of coding processes. These technologies enable automated coding, reducing the time and effort required for manual coding tasks. As healthcare providers seek to optimize their operations, the adoption of advanced coding software is becoming increasingly prevalent. The market for coding software is projected to grow at a CAGR of approximately 10% over the next few years, indicating a strong trend towards automation and efficiency. This technological evolution is likely to reshape the landscape of the medical coding market, making it more responsive to the needs of healthcare providers.