Rising Industrial Applications

The lead acid-battery market is experiencing growth due to the rising demand for industrial applications in Germany. Industries such as telecommunications, uninterruptible power supplies (UPS), and material handling are increasingly relying on lead acid batteries for their operations. In 2025, the industrial segment is expected to account for approximately 30% of the total lead acid-battery market share. This trend suggests that manufacturers must focus on developing batteries that meet the specific needs of these industries, such as enhanced durability and performance under varying conditions, thereby driving innovation within the lead acid-battery market.

Increased Recycling Initiatives

Germany has established itself as a leader in recycling initiatives, particularly in the lead acid-battery market. The country has implemented stringent regulations that promote the recycling of lead acid batteries, ensuring that over 95% of the materials are recovered and reused. This focus on sustainability not only reduces environmental impact but also enhances the economic viability of the lead acid-battery market. As of 2025, the recycling rate for lead acid batteries in Germany is projected to remain above 90%, indicating a robust circular economy that supports the market's growth and encourages manufacturers to innovate in battery design and production.

Cost Competitiveness of Lead Acid Batteries

The cost competitiveness of lead acid batteries continues to be a significant driver in the German market. Compared to alternative battery technologies, lead acid batteries offer a lower initial investment, making them an attractive option for consumers and businesses alike. In 2025, the average price of lead acid batteries is expected to remain stable, while prices for lithium-ion batteries may increase due to raw material shortages. This price stability positions the lead acid-battery market favorably, particularly for applications where cost is a critical factor, such as in automotive and backup power systems, thus ensuring sustained demand.

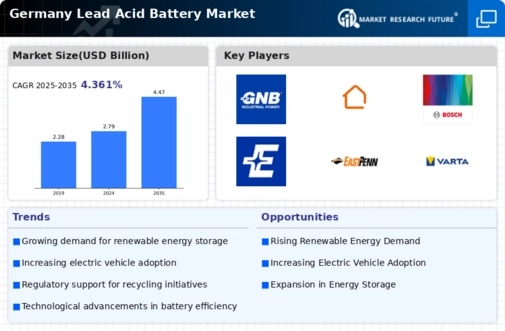

Growing Demand for Renewable Energy Storage

The increasing emphasis on renewable energy sources in Germany has led to a heightened demand for energy storage solutions, particularly in the lead acid-battery market. As the country aims to transition to a more sustainable energy system, lead acid batteries are being utilized for energy storage in solar and wind applications. In 2025, the market for energy storage systems is projected to grow by approximately 20%, with lead acid batteries playing a crucial role due to their cost-effectiveness and reliability. This trend indicates a significant opportunity for manufacturers and suppliers within the lead acid-battery market, as they can cater to the rising need for efficient energy storage solutions.

Expansion of Electric Vehicle Infrastructure

The expansion of electric vehicle (EV) infrastructure in Germany is a pivotal driver for the lead acid-battery market. With the government investing heavily in charging stations and incentives for EV adoption, the demand for batteries, including lead acid types, is expected to rise. In 2025, the number of electric vehicles on German roads is anticipated to exceed 1 million, creating a substantial market for batteries. Lead acid batteries, known for their robustness and affordability, are likely to be favored in certain segments of the EV market, particularly in low-speed electric vehicles and hybrid applications, thus bolstering the lead acid-battery market.