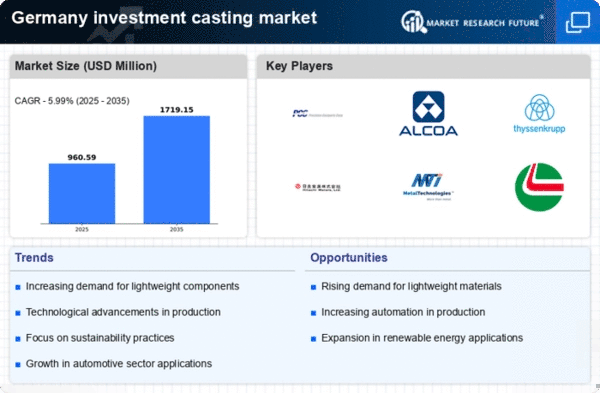

The investment casting market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and technological advancements. Key players such as Thyssenkrupp AG (DE), KSM Castings Group (DE), and Precision Castparts Corp (US) are actively pursuing strategies that enhance their operational efficiencies and market reach. Thyssenkrupp AG (DE) focuses on integrating digital technologies into its manufacturing processes, which not only streamlines operations but also reduces waste, aligning with sustainability goals. Meanwhile, KSM Castings Group (DE) emphasizes localizing its manufacturing capabilities to better serve regional clients, thereby enhancing responsiveness and reducing lead times. Collectively, these strategies contribute to a moderately fragmented market structure, where innovation and operational excellence are pivotal for competitive differentiation.In terms of business tactics, companies are increasingly localizing their manufacturing operations and optimizing supply chains to mitigate risks and enhance efficiency. The competitive structure of the market appears to be moderately fragmented, with several players vying for market share. This fragmentation allows for a diverse range of offerings, yet the influence of major players like Alcoa Corporation (US) and Hitachi Metals Ltd (JP) remains substantial, as they leverage their global presence to drive innovation and capture emerging opportunities.

In October Thyssenkrupp AG (DE) announced a strategic partnership with a leading technology firm to develop advanced AI-driven solutions for its investment casting processes. This collaboration is expected to enhance production efficiency and reduce operational costs, positioning Thyssenkrupp as a frontrunner in the adoption of smart manufacturing technologies. The strategic importance of this move lies in its potential to significantly improve product quality and operational agility, which are critical in meeting the evolving demands of the market.

In September KSM Castings Group (DE) expanded its production facility in Germany, investing approximately €10 million to increase its capacity for high-precision components. This expansion is indicative of KSM's commitment to meeting the growing demand for lightweight and complex castings in the automotive and aerospace sectors. The strategic significance of this investment is underscored by the need for manufacturers to adapt to changing industry requirements, particularly in the context of sustainability and efficiency.

In August Alcoa Corporation (US) launched a new line of eco-friendly investment casting materials aimed at reducing the carbon footprint of its production processes. This initiative aligns with global trends towards sustainability and positions Alcoa as a leader in environmentally responsible manufacturing. The strategic importance of this development is profound, as it not only addresses regulatory pressures but also caters to the increasing consumer demand for sustainable products.

As of November the competitive trends in the investment casting market are heavily influenced by digitalization, sustainability initiatives, and the integration of AI technologies. Strategic alliances are becoming increasingly vital, as companies seek to leverage complementary strengths to enhance their market positions. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to adapt to these evolving trends.