Focus on Safety and Reliability

Safety and reliability are paramount in industries utilizing piping systems, particularly in Germany's stringent regulatory environment. The fluoropolymer lined-pipes-fittings market benefits from the increasing emphasis on safety standards, as these materials provide enhanced protection against leaks and failures. The ability of fluoropolymers to maintain integrity under high pressure and temperature conditions is a key driver for their adoption. As industries prioritize operational safety, the demand for reliable piping solutions is expected to grow. This focus on safety is likely to contribute to a projected market growth of 4% annually, underscoring the importance of fluoropolymer lined solutions in maintaining safe operational environments.

Increasing Industrial Applications

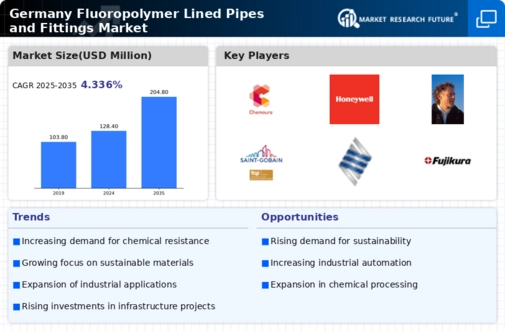

The fluoropolymer lined-pipes-fittings market is experiencing growth due to the increasing industrial applications across various sectors in Germany. Industries such as chemical processing, oil and gas, and pharmaceuticals are increasingly adopting fluoropolymer lined solutions for their superior resistance to corrosive substances. This trend is likely to continue, as the demand for high-performance materials that can withstand extreme conditions is on the rise. In 2025, the market is projected to reach a valuation of approximately €200 million, reflecting a compound annual growth rate (CAGR) of around 5%. The versatility of fluoropolymer lined pipes and fittings makes them suitable for a wide range of applications, thereby driving market expansion.

Rising Demand from the Energy Sector

The energy sector in Germany is a significant driver for the fluoropolymer lined-pipes-fittings market. With the ongoing transition towards renewable energy sources and the need for efficient energy management, there is an increasing demand for reliable piping solutions that can withstand harsh conditions. Fluoropolymer lined pipes and fittings are particularly suited for applications in the energy sector due to their resistance to corrosion and high temperatures. As investments in energy infrastructure continue to grow, the market is projected to expand by approximately 5% annually. This trend highlights the critical role of fluoropolymer lined solutions in supporting the energy sector's evolving needs.

Environmental Regulations and Compliance

The fluoropolymer lined-pipes-fittings market is significantly influenced by the evolving environmental regulations in Germany. Stricter compliance requirements regarding emissions and waste management are prompting industries to seek materials that minimize environmental impact. Fluoropolymer lined solutions are favored for their durability and resistance to chemical degradation, which aligns with sustainability goals. As companies strive to meet regulatory standards, the market is expected to witness a surge in demand, potentially increasing by 6% in the coming years. This trend indicates a shift towards environmentally friendly materials, positioning fluoropolymer lined pipes and fittings as a viable solution for compliance.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of fluoropolymer lined-pipes-fittings are driving market growth in Germany. Innovations such as improved lining techniques and enhanced bonding methods are leading to higher quality products with better performance characteristics. These advancements not only increase the lifespan of the fittings but also reduce production costs, making them more accessible to various industries. The market is likely to benefit from these innovations, with an anticipated growth rate of 5% as manufacturers adopt new technologies to enhance product offerings. This focus on innovation is crucial for maintaining competitiveness in the fluoropolymer lined-pipes-fittings market.