Increasing Industrial Applications

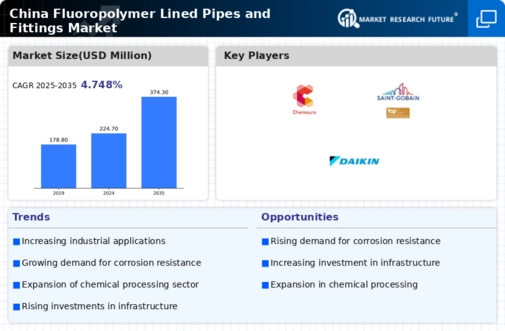

The fluoropolymer lined-pipes-fittings market is experiencing growth due to the increasing industrial applications across various sectors in China. Industries such as oil and gas, chemical processing, and pharmaceuticals are increasingly adopting fluoropolymer lined solutions for their superior resistance to corrosive substances and high temperatures. This trend is likely to continue as industries seek to enhance operational efficiency and safety. The market is projected to witness a compound annual growth rate (CAGR) of approximately 6% over the next five years, driven by the need for reliable and durable piping systems. As industries expand, the demand for fluoropolymer lined-pipes-fittings is expected to rise, further solidifying their role in critical applications.

Rising Investment in Infrastructure

China's ongoing investment in infrastructure development is a key driver for the fluoropolymer lined-pipes-fittings market. The government has prioritized infrastructure projects, including water treatment facilities, chemical plants, and energy production, which require high-performance piping systems. Fluoropolymer lined-pipes-fittings are particularly suited for these applications due to their durability and resistance to corrosion. As infrastructure projects expand, the demand for these specialized fittings is likely to increase. The market could see a growth trajectory of approximately 7% as new projects are initiated and existing facilities are upgraded to meet modern standards.

Growing Awareness of Chemical Resistance

The growing awareness of the benefits of chemical resistance in piping systems is influencing the fluoropolymer lined-pipes-fittings market in China. Industries are increasingly recognizing the importance of using materials that can withstand aggressive chemicals without degrading. Fluoropolymer lined solutions offer exceptional chemical resistance, making them ideal for various applications, including chemical processing and waste management. As awareness spreads, more companies are likely to transition to these advanced materials, driving market growth. The fluoropolymer lined-pipes-fittings market may experience an increase of approximately 5% as industries prioritize safety and longevity in their piping systems.

Regulatory Compliance and Safety Standards

In China, stringent regulatory compliance and safety standards are driving the fluoropolymer lined-pipes-fittings market. Industries are mandated to adhere to safety regulations that require the use of materials capable of withstanding harsh chemicals and extreme conditions. Fluoropolymer lined solutions are recognized for their ability to meet these standards, making them a preferred choice for many manufacturers. The increasing focus on workplace safety and environmental protection is likely to propel the demand for these products. As companies strive to comply with regulations, the fluoropolymer lined-pipes-fittings market is expected to benefit significantly, with an anticipated growth rate of around 5% in the coming years.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of fluoropolymer lined-pipes-fittings are contributing to market growth in China. Innovations in production techniques are enhancing the quality and performance of these products, making them more appealing to end-users. Improved manufacturing capabilities allow for the production of more complex designs and larger diameters, catering to diverse industrial needs. As manufacturers adopt advanced technologies, the fluoropolymer lined-pipes-fittings market is expected to expand, with a projected growth rate of around 6% over the next few years. This trend indicates a shift towards more efficient and effective piping solutions.