Advancements in Biometric Technology

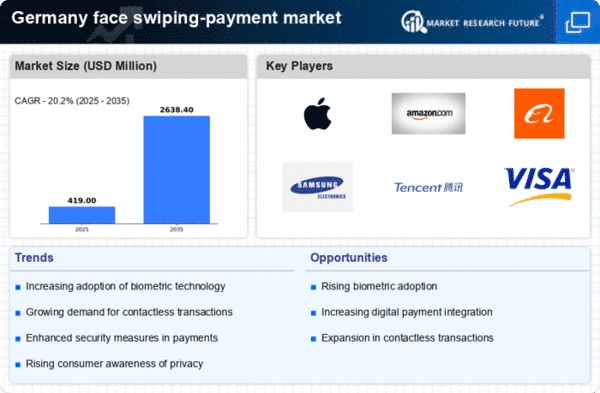

Technological advancements in biometric systems are significantly influencing the face swiping-payment market in Germany. Innovations in facial recognition technology have improved accuracy and speed, making it a viable option for secure transactions. In 2025, the market for biometric payment solutions is projected to grow by 30%, driven by the increasing reliability of these systems. The face swiping-payment market stands to gain from these advancements, as businesses look to adopt cutting-edge technology to enhance customer experience and security. Moreover, the integration of artificial intelligence in biometric systems may further refine the accuracy of facial recognition, potentially reducing fraud and increasing consumer trust in these payment methods.

Increased Focus on Security Measures

Security concerns remain a pivotal driver for the face swiping-payment market in Germany. As digital transactions proliferate, the need for robust security measures becomes paramount. The face swiping-payment market is likely to see heightened interest in solutions that offer enhanced security features, such as biometric authentication. In 2025, it is estimated that 70% of consumers prioritize security when choosing payment methods. This focus on security may lead to increased investments in technologies that mitigate risks associated with fraud and data breaches. Consequently, businesses that adopt face swiping technology may find themselves at a competitive advantage, as they can assure customers of secure transaction processes.

Rising Demand for Contactless Payments

The face swiping-payment market in Germany is experiencing a notable surge in demand for contactless payment solutions. As consumers increasingly prefer quick and efficient transaction methods, the adoption of face swiping technology is likely to rise. Recent data indicates that contactless payments accounted for approximately 45% of all transactions in Germany in 2025. This trend suggests that consumers are gravitating towards innovative payment methods that enhance convenience and speed. The face swiping-payment market is poised to benefit from this shift, as businesses seek to implement solutions that align with consumer preferences for seamless transactions. Furthermore, the integration of biometric technology into payment systems may further drive this demand, as it offers enhanced security and user experience.

Consumer Demand for Enhanced User Experience

The face swiping-payment market in Germany is increasingly driven by consumer demand for enhanced user experiences. As customers seek faster and more intuitive payment methods, the appeal of face swiping technology becomes more pronounced. In 2025, surveys indicate that 60% of consumers prefer payment solutions that minimize transaction times. This trend suggests that the face swiping-payment market must prioritize user-friendly interfaces and seamless integration into existing payment systems. Businesses that successfully implement these technologies may not only improve customer satisfaction but also increase transaction volumes. The emphasis on user experience is likely to shape the future landscape of payment solutions in Germany.

Government Initiatives Supporting Digital Payments

Government initiatives aimed at promoting digital payment solutions are playing a crucial role in shaping the face swiping-payment market in Germany. Policies encouraging cashless transactions and the development of a digital infrastructure are likely to foster growth in this sector. In 2025, the German government has allocated €500 million to enhance digital payment systems, which may include support for biometric payment technologies. The face swiping-payment market could benefit from these initiatives, as they create a conducive environment for businesses to innovate and adopt new payment methods. Furthermore, such government backing may enhance consumer confidence in using face swiping technology, thereby accelerating its adoption.