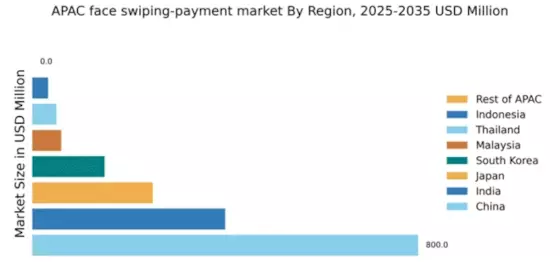

China : Unmatched Growth and Innovation

China holds a staggering 800.0 million in market value, representing 50% of the APAC face swiping-payment market. Key growth drivers include rapid digitalization, a tech-savvy population, and government support for cashless transactions. The Chinese government has implemented favorable regulations, promoting fintech innovations and enhancing infrastructure, particularly in urban areas. Cities like Beijing and Shanghai are at the forefront, showcasing advanced payment technologies and consumer adoption trends.

India : Transforming Financial Transactions

India's face swiping-payment market is valued at 400.0 million, accounting for 25% of the APAC market. The growth is driven by increasing smartphone penetration, government initiatives like Digital India, and a young population eager for tech solutions. Regulatory frameworks are evolving to support digital payments, while infrastructure improvements in urban centers are facilitating this shift. Cities like Bengaluru and Mumbai are key markets, witnessing a surge in digital payment adoption.

Japan : A Blend of Tradition and Innovation

Japan's market value stands at 250.0 million, representing 15.6% of the APAC market. The growth is fueled by a strong emphasis on technology and consumer trust in digital solutions. Government policies are encouraging cashless transactions, with initiatives aimed at enhancing cybersecurity. Major cities like Tokyo and Osaka are leading the charge, with a competitive landscape featuring players like Sony and Rakuten. The retail and hospitality sectors are particularly active in adopting face swiping payments.

South Korea : A Leader in Digital Payment Solutions

South Korea's face swiping-payment market is valued at 150.0 million, making up 9.4% of the APAC market. The country is known for its advanced technological infrastructure and high smartphone penetration. Government initiatives are promoting cashless transactions, while local companies like Samsung are at the forefront of innovation. Key markets include Seoul and Busan, where a competitive landscape features both local and international players. The retail and entertainment sectors are rapidly adopting these payment solutions.

Malaysia : Growth Driven by Young Consumers

Malaysia's market value is 60.0 million, representing 3.8% of the APAC market. The growth is driven by a youthful population and increasing smartphone usage. Government initiatives, such as the Malaysia Digital Economy Blueprint, are fostering a conducive environment for digital payments. Key cities like Kuala Lumpur are witnessing a rise in adoption rates. The competitive landscape includes local players and international giants, with retail and e-commerce sectors leading the way in face swiping payments.

Thailand : Adapting to New Payment Trends

Thailand's face swiping-payment market is valued at 50.0 million, accounting for 3.1% of the APAC market. The growth is driven by increasing smartphone adoption and government support for digital payment systems. Initiatives like the Thailand 4.0 policy are enhancing the digital economy. Bangkok is a key market, with a competitive landscape featuring both local and international players. The tourism and retail sectors are particularly active in adopting face swiping payments.

Indonesia : A Market on the Rise

Indonesia's market value is 32.92 million, representing 2.1% of the APAC market. The growth is driven by a large, young population and increasing smartphone penetration. Government initiatives are promoting digital financial inclusion, while infrastructure improvements are facilitating access to digital payment solutions. Key cities like Jakarta are emerging as significant markets. The competitive landscape includes local startups and international players, with retail and e-commerce sectors leading the adoption of face swiping payments.

Rest of APAC : Exploring New Market Opportunities

The Rest of APAC shows a nascent face swiping-payment market with no significant value recorded. However, the potential for growth is substantial, driven by increasing smartphone adoption and digital literacy. Various governments are beginning to recognize the importance of cashless transactions, leading to evolving regulatory frameworks. Countries like Vietnam and the Philippines are starting to explore digital payment solutions, creating opportunities for market entry and expansion.