Government Incentives and Policies

The German government actively promotes the adoption of electric vehicles (EVs) through various incentives and policies, which significantly bolster the Germany Electric Vehicle Charging Infrastructure Market. Initiatives such as the 'Environmental Bonus' provide financial support for EV purchases, while the 'Charging Infrastructure Expansion Act' aims to enhance the charging network across the country. As of 2025, Germany has established over 60,000 public charging points, reflecting a commitment to achieving 1 million charging stations by 2030. These policies not only encourage consumers to transition to electric mobility but also stimulate investments in charging infrastructure, thereby driving growth in the germany electric vehicle charging infrastructure market.

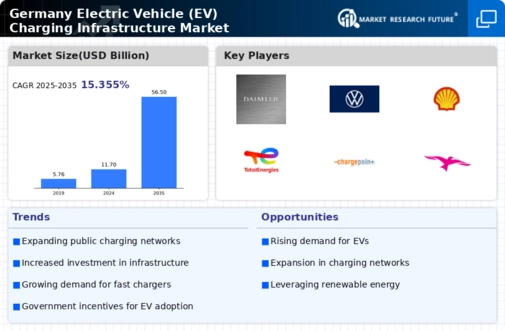

Rising Demand for Electric Vehicles

The increasing consumer demand for electric vehicles in Germany is a pivotal driver for the Germany Electric Vehicle Charging Infrastructure Market. In 2025, electric vehicle sales accounted for approximately 25% of total vehicle sales, indicating a robust shift towards sustainable transportation. This surge in EV adoption necessitates a corresponding expansion of charging infrastructure to accommodate the growing number of electric vehicles on the road. As more consumers opt for electric mobility, the demand for accessible and efficient charging solutions intensifies, prompting both public and private sectors to invest in the development of charging stations, thus propelling the germany electric vehicle charging infrastructure market forward.

Urbanization and Infrastructure Development

The ongoing urbanization in Germany is a critical factor influencing the Germany Electric Vehicle Charging Infrastructure Market. As cities expand and populations grow, the need for sustainable transportation solutions becomes increasingly urgent. Urban areas are witnessing a rise in electric vehicle usage, which necessitates the development of adequate charging infrastructure. Local governments are responding by integrating charging stations into urban planning initiatives, ensuring that charging points are conveniently located in residential and commercial areas. This proactive approach not only supports the growing number of electric vehicles but also aligns with Germany's broader sustainability goals, thereby driving the growth of the germany electric vehicle charging infrastructure market.

Technological Innovations in Charging Solutions

Technological advancements in charging solutions are transforming the landscape of the Germany Electric Vehicle Charging Infrastructure Market. Innovations such as ultra-fast charging stations and wireless charging technology are enhancing the efficiency and convenience of charging processes. For instance, ultra-fast chargers can deliver up to 350 kW, allowing EVs to charge significantly faster than traditional chargers. This technological evolution not only improves user experience but also encourages more consumers to adopt electric vehicles, thereby increasing the demand for charging infrastructure. As these technologies continue to evolve, they are likely to play a crucial role in shaping the future of the germany electric vehicle charging infrastructure market.

Environmental Awareness and Sustainability Goals

Growing environmental awareness among consumers and businesses is significantly impacting the Germany Electric Vehicle Charging Infrastructure Market. As climate change concerns escalate, there is a collective push towards reducing carbon emissions and promoting sustainable practices. Germany has set ambitious targets to become carbon neutral by 2045, which includes a substantial increase in electric vehicle adoption. This heightened focus on sustainability is encouraging investments in charging infrastructure, as stakeholders recognize the importance of providing accessible charging solutions to support the transition to electric mobility. Consequently, the alignment of consumer values with sustainability goals is likely to further stimulate the growth of the germany electric vehicle charging infrastructure market.