Evolving Consumer Preferences

Consumer preferences in Germany are shifting towards eco-friendly transportation solutions, significantly impacting the electric truck market. Businesses are increasingly prioritizing sustainability in their supply chains, leading to a higher demand for electric trucks. According to recent surveys, approximately 70% of logistics companies in Germany express a preference for electric vehicles due to their lower operational costs and environmental benefits. This trend suggests that as more companies adopt electric trucks, the market is likely to expand, driven by the need for cleaner and more efficient transportation options.

Rising Environmental Concerns

The electric truck market in Germany is experiencing a surge in demand driven by increasing environmental awareness among consumers and businesses. As climate change becomes a pressing issue, companies are seeking sustainable alternatives to traditional diesel trucks. The German government has set ambitious targets to reduce greenhouse gas emissions by 55% by 2030, which is likely to propel the adoption of electric trucks. Furthermore, studies indicate that electric trucks can reduce CO2 emissions by up to 80% compared to their diesel counterparts. This shift towards greener logistics solutions is expected to reshape the electric truck market, as businesses align their operations with sustainability goals.

Corporate Sustainability Goals

Many corporations in Germany are setting ambitious sustainability goals, which is driving the electric truck market. Companies are increasingly recognizing the importance of reducing their carbon footprint and are committing to using electric vehicles in their logistics operations. Reports indicate that over 60% of major German corporations have pledged to achieve carbon neutrality by 2045. This commitment is likely to lead to a substantial increase in the demand for electric trucks, as businesses seek to align their transportation methods with their sustainability objectives. The electric truck market is thus positioned to grow as corporations prioritize eco-friendly logistics solutions.

Advancements in Charging Technology

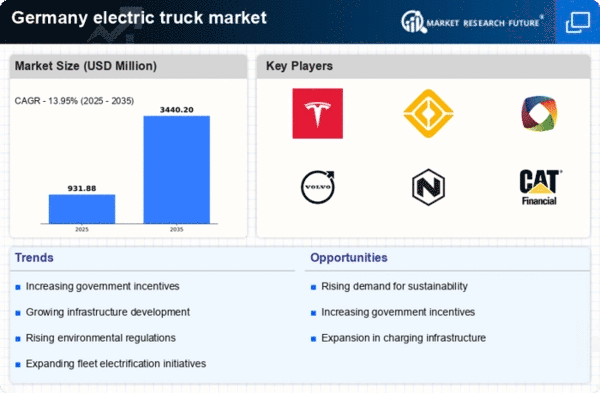

The electric truck market in Germany is benefiting from rapid advancements in charging technology. Innovations such as ultra-fast charging stations are being developed, which can recharge electric trucks in under an hour. This improvement addresses one of the primary concerns regarding electric vehicle adoption: charging time. The German government is investing heavily in expanding the charging infrastructure, with plans to install over 1,000 fast-charging stations by 2025. This expansion is expected to enhance the operational efficiency of electric trucks, making them a more viable option for logistics companies and further stimulating market growth.

Economic Incentives for Fleet Electrification

Economic incentives play a crucial role in the growth of the electric truck market in Germany. The government has introduced various financial support mechanisms, including grants and tax reductions, to encourage businesses to transition to electric fleets. For instance, companies can receive up to €8,000 in subsidies for each electric truck purchased. This financial support is likely to lower the total cost of ownership, making electric trucks more attractive to fleet operators. As these incentives continue to evolve, they are expected to significantly boost the adoption rate of electric trucks across various industries.