Rising Environmental Concerns

The Electric Lift Truck Market is increasingly influenced by rising environmental concerns among consumers and businesses alike. As sustainability becomes a priority, companies are actively seeking to reduce their carbon footprints. Electric lift trucks, known for their lower emissions compared to traditional internal combustion models, are gaining traction as a viable alternative. Recent studies indicate that electric lift trucks can reduce greenhouse gas emissions by up to 50% in comparison to their diesel counterparts. This shift towards eco-friendly solutions is not only beneficial for the environment but also aligns with corporate social responsibility initiatives. Consequently, the Electric Lift Truck Market is likely to witness a robust increase in demand as organizations prioritize sustainable practices in their operations, thereby fostering a more environmentally conscious approach to material handling.

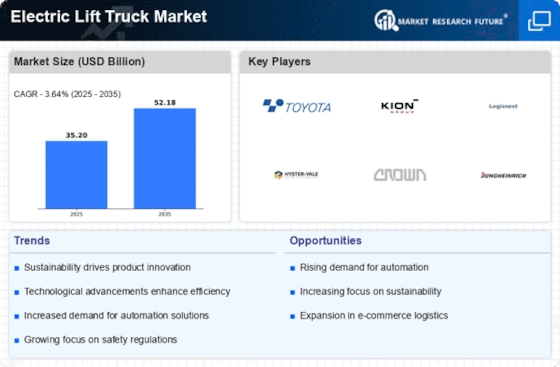

Increased Demand for Automation

The Electric Lift Truck Market is experiencing a notable surge in demand for automation within warehouses and distribution centers. As companies strive to enhance operational efficiency, the integration of electric lift trucks equipped with advanced automation technologies becomes increasingly appealing. According to recent data, the market for automated electric lift trucks is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend indicates a shift towards more sophisticated material handling solutions, as businesses seek to reduce labor costs and improve productivity. Furthermore, the adoption of automation is likely to drive innovation in electric lift truck designs, leading to enhanced performance and reliability. As a result, the Electric Lift Truck Market is poised for significant growth, driven by the need for automated solutions that can meet the demands of modern logistics.

Government Incentives and Support

The Electric Lift Truck Market is bolstered by various government incentives and support programs aimed at promoting the adoption of electric vehicles, including lift trucks. Many governments are implementing policies that provide financial assistance, tax breaks, and grants to businesses that invest in electric lift truck technology. These initiatives are designed to encourage companies to transition from fossil fuel-powered equipment to electric alternatives, thereby reducing emissions and promoting sustainability. Recent reports indicate that regions with strong government support for electric vehicles have seen a 20% increase in electric lift truck sales. This trend suggests that as governments continue to prioritize environmental initiatives, the Electric Lift Truck Market will likely experience accelerated growth, driven by favorable policies and financial incentives.

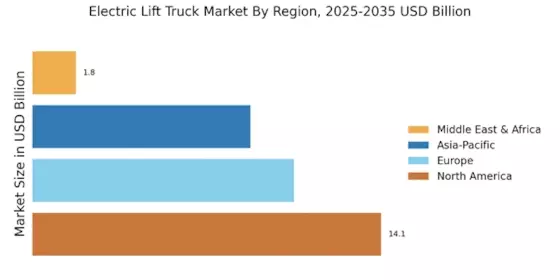

Growth of E-commerce and Logistics Sector

The Electric Lift Truck Market is experiencing growth driven by the expansion of the e-commerce and logistics sector. As online shopping continues to gain popularity, warehouses and distribution centers are under pressure to optimize their operations to meet increasing consumer demands. Electric lift trucks are becoming essential tools in this transformation, as they offer the agility and efficiency required for high-volume order fulfillment. Recent statistics indicate that the e-commerce sector is projected to grow by over 15% annually, leading to a corresponding increase in demand for electric lift trucks. This trend highlights the critical role that electric lift trucks play in modern supply chains, as businesses seek to enhance their material handling capabilities. Consequently, the Electric Lift Truck Market is likely to thrive as it adapts to the evolving needs of the logistics landscape.

Technological Innovations in Battery Technology

The Electric Lift Truck Market is significantly impacted by advancements in battery technology, which enhance the performance and efficiency of electric lift trucks. Innovations such as lithium-ion batteries are becoming increasingly prevalent, offering longer operational hours and shorter charging times. This technological evolution is crucial, as it addresses one of the primary concerns associated with electric lift trucks: battery life and charging infrastructure. Recent data suggests that the adoption of lithium-ion batteries can improve energy efficiency by up to 30%, making electric lift trucks more competitive against traditional models. As battery technology continues to evolve, the Electric Lift Truck Market is expected to benefit from increased adoption rates, as businesses recognize the advantages of investing in more efficient and reliable electric lift truck solutions.