Public Awareness Campaigns

Public awareness campaigns are playing a crucial role in shaping the electric mobility market in Germany. These initiatives aim to educate consumers about the benefits of electric vehicles, including lower operating costs, reduced emissions, and government incentives. As awareness increases, consumer interest in electric mobility is likely to grow, leading to higher adoption rates. The German government, along with various NGOs, is actively promoting electric mobility through informational programs and events. Recent surveys indicate that approximately 70% of potential car buyers in Germany are now considering electric vehicles as a viable option. This shift in consumer perception is expected to drive demand in the electric mobility market, as more individuals recognize the advantages of transitioning to electric transportation.

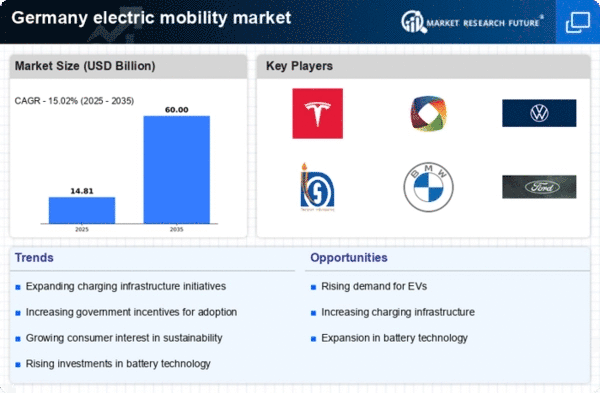

Technological Innovations in EVs

Technological innovations in electric vehicles are a significant driver for the electric mobility market in Germany. Advancements in battery technology, such as solid-state batteries, are enhancing the performance and efficiency of EVs. These innovations are expected to increase the driving range of electric vehicles, making them more appealing to consumers. Furthermore, improvements in charging technology, including ultra-fast charging solutions, are reducing charging times, which is crucial for user convenience. As of 2025, the average range of new electric vehicles in Germany has increased to approximately 500 km on a single charge, which is likely to further stimulate market growth. The continuous evolution of technology in the electric mobility market not only enhances vehicle performance but also contributes to a more sustainable transportation ecosystem.

Regulatory Framework Enhancements

The electric mobility market in Germany is experiencing a robust transformation due to the implementation of stringent regulatory frameworks. The German government has established ambitious targets for reducing greenhouse gas emissions, aiming for a 55% reduction by 2030 compared to 1990 levels. This regulatory environment encourages manufacturers to invest in electric vehicles (EVs) and infrastructure. Additionally, the European Union's regulations on CO2 emissions for new cars are pushing automakers to accelerate their transition to electric mobility. As a result, the electric mobility market is likely to see a surge in EV production and sales, with projections indicating that EVs could account for over 30% of new car sales by 2030. This regulatory push is a critical driver for the electric mobility market, fostering innovation and investment in sustainable transportation solutions.

Corporate Sustainability Initiatives

Corporate sustainability initiatives are increasingly shaping the electric mobility market in Germany. Many companies are adopting electric fleets as part of their commitment to reducing carbon footprints and enhancing corporate social responsibility. For instance, major corporations are transitioning to electric delivery vehicles, which not only lowers emissions but also reduces operational costs in the long run. The electric mobility market is likely to benefit from this trend, as businesses recognize the financial and environmental advantages of electrification. Reports suggest that companies that invest in electric mobility can achieve up to 20% savings in fuel costs. This shift towards sustainable practices is expected to drive demand for electric vehicles, as businesses seek to align with consumer preferences for environmentally friendly options, thereby contributing to the overall growth of the electric mobility market.

Investment in Charging Infrastructure

Investment in charging infrastructure is a pivotal driver for the electric mobility market in Germany. The government, alongside private sector stakeholders, is actively expanding the network of charging stations to facilitate the adoption of electric vehicles. As of 2025, Germany has over 60,000 public charging points, with plans to increase this number significantly. This expansion is essential, as studies indicate that the availability of charging stations directly influences consumer purchasing decisions. Furthermore, the German government has allocated approximately €3 billion to enhance charging infrastructure by 2030, aiming to ensure that charging stations are accessible within a 10-minute drive for 90% of the population. This investment not only supports the growth of the electric mobility market but also alleviates range anxiety among potential EV buyers, thereby promoting wider acceptance of electric vehicles.