Growing Focus on Automation

The trend towards automation is reshaping the downstream processing market in Germany. Companies are increasingly adopting automated systems to enhance operational efficiency and reduce human error. This shift is driven by the need for consistent product quality and the ability to scale operations rapidly. In 2025, it is estimated that automated solutions will account for over 40% of the downstream processing market, reflecting a significant transformation in how processes are managed. Automation not only streamlines workflows but also reduces labor costs, making it a compelling choice for companies looking to optimize their operations. This growing focus on automation is likely to redefine the competitive landscape of the downstream processing market.

Regulatory Compliance Pressure

the downstream processing market in Germany faces heightened pressure due to stringent regulatory compliance requirements.. Regulatory bodies are increasingly enforcing guidelines that ensure safety, quality, and environmental sustainability. This has led to a surge in demand for advanced downstream processing technologies that can meet these standards. Companies are investing significantly in compliance-related innovations, which is projected to drive market growth. In 2025, the market is expected to reach a valuation of approximately €1.5 billion, with compliance-related expenditures accounting for nearly 30% of total operational costs. This trend indicates that adherence to regulations is not merely a legal obligation but a strategic imperative for companies operating in the downstream processing market.

Rising Demand for Biopharmaceuticals

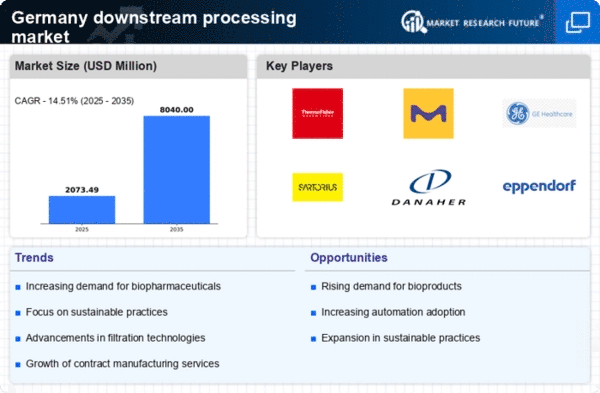

The growing demand for biopharmaceuticals is a key driver in the downstream processing market in Germany. As the healthcare sector increasingly shifts towards biologics, the need for efficient downstream processing solutions becomes critical. In 2025, the biopharmaceutical market in Germany is projected to grow at a CAGR of 8%, leading to an increased requirement for downstream processing technologies that can handle complex purification and separation processes. This trend suggests that companies specializing in downstream processing are likely to benefit from the expanding biopharmaceutical sector, as they provide essential services that ensure product efficacy and safety. the downstream processing market is positioned to capitalize on this burgeoning demand..

Investment in Research and Development

Investment in research and development (R&D) is a significant driver for the downstream processing market in Germany. Companies are increasingly allocating resources to innovate and enhance their processing techniques, aiming to improve efficiency and reduce costs. In 2025, R&D spending in the bioprocessing sector is expected to exceed €200 million, reflecting a commitment to advancing downstream processing technologies. This investment is likely to lead to breakthroughs in purification methods and process optimization, which could enhance the overall productivity of the downstream processing market. As firms strive to maintain competitive advantages, the focus on R&D is anticipated to play a crucial role in shaping the future landscape of the market.

Increased Collaboration with Academic Institutions

Collaboration with academic institutions is emerging as a vital driver for the downstream processing market in Germany. These partnerships facilitate knowledge transfer and innovation, enabling companies to leverage cutting-edge research in their processing techniques. In 2025, it is projected that collaborations will lead to the development of novel downstream processing methods, enhancing efficiency and product quality. Such partnerships are likely to result in a more skilled workforce and foster a culture of innovation within the industry. The downstream processing market stands to benefit significantly from these collaborations, as they can accelerate the adoption of new technologies and improve overall market competitiveness.