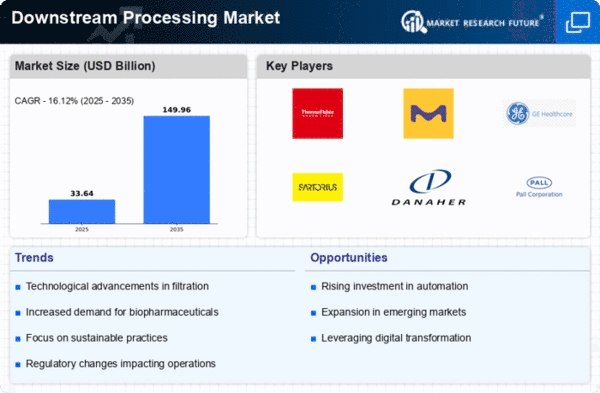

Market Growth Projections

The Global Downstream Processing Market Industry is poised for substantial growth, with projections indicating a market value of 12.8 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 5.3% from 2025 to 2035. The increasing demand for biopharmaceuticals, coupled with technological advancements and regulatory support, is expected to drive this expansion. As companies invest in innovative processing techniques and sustainable practices, the market is likely to witness a transformation that aligns with evolving healthcare needs and environmental considerations.

Regulatory Support and Compliance

Regulatory support significantly influences the Global Downstream Processing Market Industry, as stringent guidelines ensure product safety and efficacy. Regulatory bodies worldwide are increasingly focusing on harmonizing standards, which facilitates smoother market entry for biopharmaceutical products. Compliance with these regulations necessitates robust downstream processing methods to meet quality requirements. The emphasis on regulatory compliance drives investments in advanced processing technologies, thereby enhancing the overall market landscape. As the industry adapts to evolving regulations, the demand for efficient downstream processing solutions is likely to rise, contributing to the market's growth trajectory.

Rising Demand for Biopharmaceuticals

The Global Downstream Processing Market Industry experiences a notable surge in demand for biopharmaceuticals, driven by the increasing prevalence of chronic diseases and the need for innovative therapies. As of 2024, the market is valued at approximately 7.25 USD Billion, reflecting the industry's response to the growing healthcare needs. Biopharmaceuticals, including monoclonal antibodies and vaccines, require sophisticated downstream processing techniques to ensure purity and efficacy. This trend is expected to continue, with projections indicating a market growth to 12.8 USD Billion by 2035, suggesting a robust compound annual growth rate of 5.3% from 2025 to 2035.

Growing Focus on Sustainable Practices

Sustainability is becoming increasingly important within the Global Downstream Processing Market Industry. Companies are recognizing the need to adopt environmentally friendly practices in their production processes. This includes minimizing waste, reducing energy consumption, and utilizing renewable resources. The shift towards sustainability not only aligns with global environmental goals but also appeals to consumers and stakeholders who prioritize eco-friendly products. As the industry embraces sustainable practices, it is likely to enhance its reputation and competitiveness, thereby contributing to the overall growth of the market.

Increasing Investment in Research and Development

Investment in research and development is a pivotal driver for the Global Downstream Processing Market Industry. Pharmaceutical companies are allocating substantial resources to develop novel therapies, which necessitate advanced downstream processing capabilities. This focus on R&D not only fosters innovation but also enhances the efficiency of biopharmaceutical production. As companies strive to bring new products to market, the demand for sophisticated downstream processing techniques is expected to escalate. The anticipated growth in the market, from 7.25 USD Billion in 2024 to 12.8 USD Billion by 2035, underscores the importance of R&D in shaping the future of downstream processing.

Technological Advancements in Processing Techniques

Technological advancements play a crucial role in shaping the Global Downstream Processing Market Industry. Innovations such as single-use technologies and continuous processing systems enhance efficiency and reduce contamination risks. These advancements not only streamline operations but also lower production costs, making biopharmaceutical manufacturing more accessible. Companies are increasingly adopting automated systems to improve scalability and flexibility in production. As the industry evolves, the integration of artificial intelligence and machine learning into downstream processing is anticipated to further optimize workflows, thereby supporting the projected growth of the market.