Growing Data Traffic

The exponential growth of data traffic in Canada is a significant driver for the data center-switch market. With the proliferation of IoT devices and the increasing reliance on data analytics, the volume of data generated is surging. Reports indicate that data traffic in Canadian data centers is expected to increase by over 50% by 2026. This surge necessitates the deployment of high-capacity switches that can handle increased bandwidth demands. As a result, data centers are compelled to invest in advanced switching solutions to manage this influx of data efficiently, thereby propelling the growth of the data center-switch market.

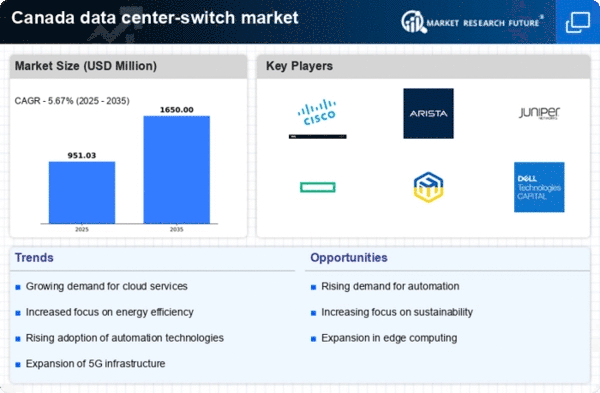

Rising Cloud Adoption

The increasing adoption of cloud computing services in Canada is driving the data center-switch market. As businesses migrate their operations to the cloud, the demand for robust and efficient data center-switch solutions rises. In 2025, it is estimated that cloud services will account for approximately 30% of IT spending in Canada, necessitating advanced switching technologies to manage data traffic effectively. This shift towards cloud infrastructure compels data centers to upgrade their switching capabilities to ensure seamless connectivity and performance. Consequently, the is expected to experience substantial growth

Emergence of 5G Technology

The rollout of 5G technology in Canada is poised to have a profound impact on the data center-switch market. With its promise of ultra-fast connectivity and low latency, 5G is expected to drive new applications and services that require robust data center infrastructure. As 5G networks expand, data centers will need to upgrade their switching capabilities to accommodate the increased data flow and support real-time applications. This transition is likely to create new opportunities for the data center-switch market, as organizations seek to leverage 5G technology to enhance their operational efficiency and service delivery.

Focus on Network Virtualization

The trend towards network virtualization in Canada is significantly influencing the data center-switch market. Organizations are increasingly adopting software-defined networking (SDN) and network functions virtualization (NFV) to enhance flexibility and scalability. This shift allows for more efficient resource allocation and management within data centers. As a result, there is a growing demand for switches that support virtualization technologies, enabling seamless integration and management of network resources. The data center-switch market is likely to benefit from this trend, as businesses seek to optimize their network infrastructure and improve overall performance.

Regulatory Compliance Requirements

In Canada, stringent regulatory compliance requirements are influencing the data center-switch market. Organizations must adhere to various data protection and privacy regulations, such as the Personal Information Protection and Electronic Documents Act (PIPEDA). These regulations necessitate the implementation of secure and reliable data management practices, which in turn drives the demand for advanced switching technologies. Data centers are increasingly investing in switches that offer enhanced security features and compliance capabilities. This trend indicates a growing need for data center-switch solutions that not only facilitate data transfer but also ensure compliance with legal standards, thereby shaping the market landscape.