Growing Cyber Threat Landscape

The Germany cybersecurity market is currently experiencing a surge in demand due to an increasingly complex cyber threat landscape. Cyberattacks, including ransomware and phishing, have escalated, prompting organizations to invest heavily in cybersecurity measures. In 2025, the number of reported cyber incidents in Germany reached over 100,000, highlighting the urgent need for robust security solutions. This growing threat has led to a heightened awareness among businesses regarding the importance of cybersecurity, driving investments in advanced technologies such as artificial intelligence and machine learning to enhance threat detection and response capabilities. As organizations strive to protect sensitive data and maintain customer trust, the demand for cybersecurity services and solutions is expected to continue its upward trajectory.

Government Initiatives and Support

The German government has implemented various initiatives to bolster the cybersecurity framework within the country, significantly impacting the Germany cybersecurity market. The establishment of the Federal Office for Information Security (BSI) has been pivotal in promoting cybersecurity standards and best practices. Additionally, the government has allocated substantial funding for cybersecurity research and development, with an investment of approximately 200 million euros in 2025 alone. These initiatives not only enhance the overall security posture of the nation but also stimulate growth in the cybersecurity sector by encouraging public-private partnerships and fostering innovation. As a result, businesses are increasingly aligning their strategies with government guidelines, further propelling the demand for cybersecurity solutions.

Digital Transformation and Cloud Adoption

The ongoing digital transformation across various sectors in Germany is a significant driver for the cybersecurity market. As organizations migrate to cloud-based solutions, the need for comprehensive cybersecurity measures becomes paramount. In 2025, it was estimated that over 70% of German companies had adopted cloud services, creating new vulnerabilities that cybercriminals are eager to exploit. This shift necessitates the implementation of advanced security protocols to safeguard sensitive information stored in the cloud. Consequently, cybersecurity firms are witnessing a surge in demand for cloud security solutions, including identity and access management, data encryption, and threat intelligence services. The convergence of digital transformation and cybersecurity is likely to shape the future landscape of the Germany cybersecurity market.

Increased Investment in Cybersecurity Solutions

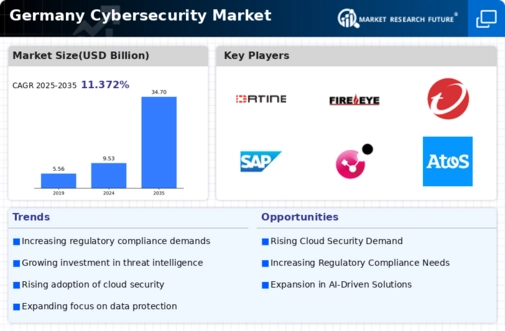

Investment in cybersecurity solutions within the Germany cybersecurity market has seen a remarkable increase, driven by the recognition of cybersecurity as a critical business priority. In 2025, the market was valued at approximately 10 billion euros, reflecting a year-on-year growth rate of 12%. Organizations are allocating larger portions of their IT budgets to cybersecurity, recognizing the potential financial and reputational damage that cyber incidents can inflict. This trend is particularly evident among small and medium-sized enterprises (SMEs), which are increasingly seeking affordable yet effective cybersecurity solutions to protect their operations. The influx of venture capital into cybersecurity startups further indicates a robust growth trajectory, as innovative solutions emerge to address evolving threats.

Rising Demand for Compliance and Risk Management

The Germany cybersecurity market is witnessing a rising demand for compliance and risk management solutions, driven by stringent regulations such as the General Data Protection Regulation (GDPR) and the IT Security Act. Organizations are compelled to ensure compliance with these regulations to avoid hefty fines and reputational damage. In 2025, it was reported that over 60% of German companies faced challenges in meeting compliance requirements, leading to an increased reliance on cybersecurity firms for guidance and support. This trend has resulted in a growing market for compliance-focused cybersecurity solutions, including risk assessment tools and audit services. As businesses navigate the complexities of regulatory compliance, the demand for specialized cybersecurity services is expected to rise, further fueling growth in the Germany cybersecurity market.