Emphasis on Digital Transformation

Digital transformation is a pivotal driver in the Germany business process management market. As organizations transition to digital platforms, there is a growing need for BPM solutions that facilitate this transformation. The German government has been actively promoting digital initiatives, which has further accelerated the adoption of BPM technologies. Recent statistics indicate that over 60% of German companies are investing in digital transformation projects, with BPM being a critical component. This emphasis on digitalization not only enhances operational capabilities but also improves customer experiences, thereby driving the demand for BPM solutions.

Focus on Customer-Centric Processes

The shift towards customer-centric processes is a significant driver in the Germany business process management market. Organizations are increasingly recognizing the importance of aligning their processes with customer needs and expectations. This trend is reflected in the growing investment in BPM solutions that enhance customer engagement and satisfaction. Data indicates that companies focusing on customer-centric BPM strategies have seen a 20% increase in customer retention rates. As businesses strive to improve their customer experiences, the demand for BPM solutions that facilitate this alignment is expected to rise, further propelling the growth of the market.

Growing Demand for Operational Efficiency

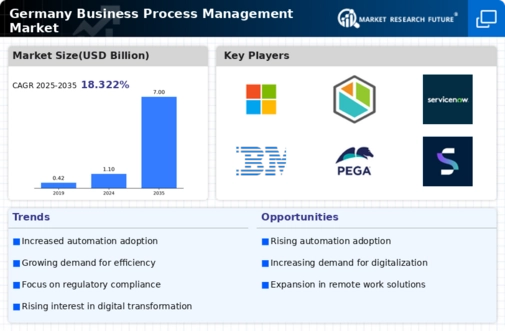

The Germany business process management market is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their processes to enhance productivity and reduce costs. According to recent data, companies that have implemented business process management solutions have reported up to a 30% increase in operational efficiency. This trend is driven by the competitive landscape in Germany, where businesses strive to maintain a competitive edge. As a result, the adoption of BPM tools and methodologies is becoming a strategic priority for many organizations, leading to a robust growth trajectory in the market.

Regulatory Compliance and Risk Management

In the Germany business process management market, regulatory compliance and risk management are increasingly becoming focal points for organizations. The stringent regulatory environment in Germany necessitates that businesses adopt BPM solutions to ensure compliance with various laws and regulations. For instance, the General Data Protection Regulation (GDPR) has compelled many companies to reevaluate their processes. As a result, the BPM market is witnessing a rise in demand for solutions that can help organizations manage compliance risks effectively. This trend is expected to continue, as companies prioritize risk management in their operational strategies.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the Germany business process management market. These advanced technologies enable organizations to automate complex processes and gain insights from data analytics. In Germany, companies are increasingly leveraging AI and ML to enhance decision-making and optimize workflows. Recent studies suggest that organizations utilizing AI-driven BPM solutions can achieve up to a 25% reduction in process cycle times. This integration not only improves efficiency but also positions companies to respond swiftly to market changes, thereby driving growth in the BPM sector.