Global Supply Chain Dynamics

The automotive oem market is affected by the complexities of global supply chain dynamics, particularly in the context of sourcing materials and components. In Germany, manufacturers are increasingly focusing on localizing supply chains to mitigate risks associated with international dependencies. This shift is evident as approximately 40% of automotive parts are now sourced locally, which enhances supply chain resilience. By reducing reliance on distant suppliers, the automotive oem market can better respond to fluctuations in demand and ensure timely production, thereby improving overall operational efficiency.

Consumer Demand for Advanced Features

The automotive oem market is witnessing a shift in consumer preferences towards vehicles equipped with advanced features such as connectivity, safety, and automation. In Germany, consumers are increasingly prioritizing technology integration, with over 60% expressing a preference for vehicles that offer smart connectivity options. This trend is pushing manufacturers to enhance their offerings, leading to increased competition in the market. As a result, automotive oem market players are investing heavily in research and development to meet these evolving consumer demands, which could potentially reshape product lines and marketing strategies.

Government Regulations and Incentives

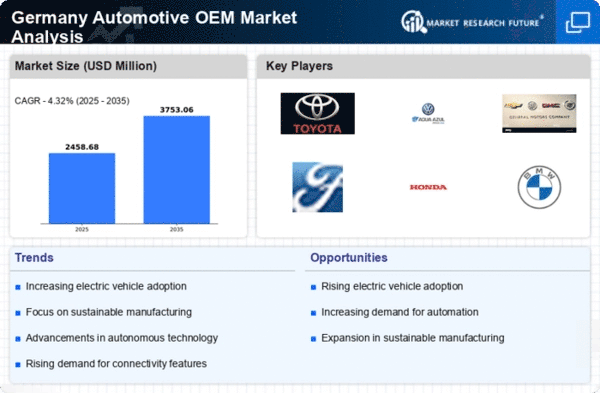

The automotive oem market is significantly influenced by government regulations aimed at reducing emissions and promoting sustainable practices. In Germany, stringent emissions standards are in place, compelling manufacturers to innovate and invest in cleaner technologies. The government also offers incentives for electric vehicle production, which has led to a notable increase in EV manufacturing. For instance, in 2025, the market share of electric vehicles in Germany is projected to reach 25%, driven by these supportive policies. Such regulatory frameworks not only shape production strategies but also encourage investment in research and development within the automotive oem market.

Technological Advancements in Manufacturing

The Automotive OEM Market is experiencing a surge in technological advancements that enhance manufacturing efficiency and product quality. Innovations such as automation, robotics, and artificial intelligence are being integrated into production lines, leading to reduced operational costs and improved output. In Germany, the adoption of Industry 4.0 principles is particularly notable, with approximately 70% of manufacturers investing in smart technologies. This shift not only streamlines processes but also allows for greater customization of vehicles, catering to consumer preferences. As a result, the automotive oem market is likely to see increased competitiveness and profitability, driven by these technological enhancements.

Investment in Electric Vehicle Infrastructure

The automotive oem market is being propelled by significant investments in electric vehicle (EV) infrastructure across Germany. The government and private sector are collaborating to expand charging networks, with plans to increase the number of charging stations to over 1 million by 2030. This infrastructure development is crucial for supporting the growing EV market, which is expected to account for a substantial share of new vehicle sales. As a result, automotive oem market players are likely to accelerate their EV production strategies, aligning with the increasing availability of charging solutions and consumer adoption.