Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the automotive finance market in Germany. The government has implemented various initiatives aimed at promoting electric vehicle adoption, including tax breaks and subsidies for buyers. These policies not only encourage consumers to consider financing options for electric vehicles but also stimulate demand within the automotive finance market. In 2025, it is expected that government incentives will contribute to a 15% increase in electric vehicle sales, further driving the need for tailored financing solutions. Financial institutions are likely to align their offerings with these policies, ensuring they remain relevant and competitive in the evolving market landscape.

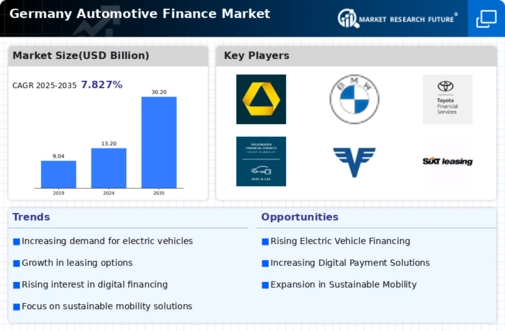

Evolving Consumer Preferences and Behavior

Consumer preferences in Germany are evolving, significantly impacting the automotive finance market. Younger generations, particularly millennials and Gen Z, are increasingly favoring leasing over traditional purchasing methods. This shift is attributed to a desire for flexibility and lower upfront costs. In 2025, it is anticipated that leasing will account for nearly 40% of all vehicle financing in Germany. Additionally, consumers are becoming more informed about financing options, often conducting extensive research before making decisions. This trend compels financial institutions to enhance their educational resources and customer support, ensuring they meet the changing needs of consumers in the automotive finance market.

Rising Demand for Sustainable Mobility Solutions

The automotive finance market in Germany is experiencing a notable shift towards sustainable mobility solutions, driven by increasing consumer awareness and government incentives. As more individuals seek eco-friendly vehicles, the demand for financing options tailored to electric and hybrid vehicles is on the rise. In 2025, approximately 30% of new car registrations in Germany are projected to be electric vehicles, necessitating innovative financing solutions. This trend is further supported by the German government’s commitment to reducing carbon emissions, which includes subsidies for electric vehicle purchases. Consequently, financial institutions are adapting their offerings to meet this demand, thereby enhancing their competitiveness in the automotive finance market.

Technological Advancements in Financing Solutions

Technological innovations are reshaping the automotive finance market in Germany, with digital platforms and mobile applications becoming increasingly prevalent. These advancements facilitate seamless loan applications and approvals, significantly enhancing customer experience. In 2025, it is estimated that over 50% of financing transactions will be conducted online, reflecting a shift towards digitalization. Moreover, the integration of artificial intelligence and data analytics allows lenders to assess creditworthiness more accurately, reducing risks associated with financing. As a result, financial institutions are likely to invest in technology to streamline processes and attract a tech-savvy customer base, thereby driving growth in the automotive finance market.

Increasing Competition Among Financial Institutions

The automotive finance market in Germany is witnessing heightened competition among financial institutions, which is influencing the availability and terms of financing options. With numerous banks and credit unions vying for market share, consumers benefit from more favorable interest rates and flexible repayment plans. In 2025, the average interest rate for auto loans is projected to remain below 4%, making financing more accessible to a broader audience. This competitive landscape encourages lenders to innovate their product offerings, such as introducing tailored financing packages for specific demographics. Consequently, this competition is likely to stimulate growth and diversification within the automotive finance market.