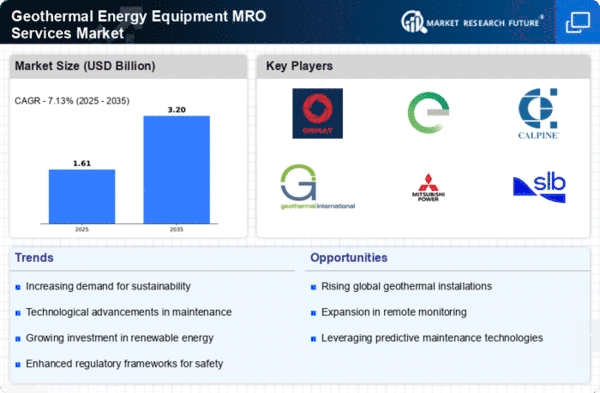

The Geothermal Energy Equipment MRO Services Market is currently characterized by a dynamic competitive landscape, driven by increasing global energy demands and a growing emphasis on sustainable energy solutions. Key players such as Ormat Technologies (US), Enel Green Power (IT), and Calpine Corporation (US) are strategically positioning themselves through innovation and regional expansion. Ormat Technologies (US) focuses on enhancing its geothermal technology portfolio, while Enel Green Power (IT) emphasizes sustainable practices and digital transformation to optimize operations. Calpine Corporation (US) is actively pursuing partnerships to bolster its service offerings, collectively shaping a competitive environment that prioritizes technological advancement and sustainability.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to thrive, while larger companies leverage their resources to capture market share through strategic initiatives.

In November Enel Green Power (IT) announced a partnership with a leading technology firm to develop AI-driven predictive maintenance solutions for geothermal plants. This strategic move is likely to enhance operational efficiency and reduce downtime, positioning Enel as a leader in integrating advanced technologies into geothermal operations. The collaboration underscores the importance of digital transformation in the MRO services sector.

In October Ormat Technologies (US) unveiled a new geothermal power plant in Nevada, which is expected to significantly increase its production capacity. This expansion not only strengthens Ormat's market position but also reflects its commitment to meeting rising energy demands through sustainable practices. The new facility is anticipated to contribute to the company's revenue growth and enhance its competitive edge in the geothermal sector.

In September Calpine Corporation (US) completed the acquisition of a regional geothermal service provider, thereby expanding its service capabilities and geographic reach. This acquisition is indicative of a broader trend where companies seek to consolidate their positions in the market through strategic mergers and acquisitions, allowing them to offer comprehensive MRO services to a wider customer base.

As of December current competitive trends in the Geothermal Energy Equipment MRO Services Market are heavily influenced by digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the landscape, enabling companies to leverage shared resources and expertise. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to adapt to these evolving trends.