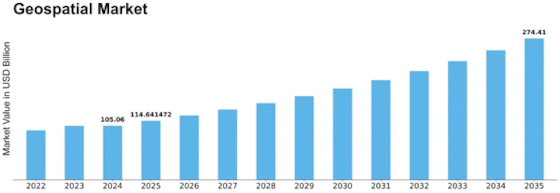

Geospatial Size

Geospatial Market Growth Projections and Opportunities

The Geospatial Market, a dynamic and rapidly evolving sector, is influenced by various market factors that shape its growth and development. One significant factor is the increasing demand for location-based services across diverse industries. As businesses recognize the value of spatial data in decision-making processes, the demand for geospatial technologies such as Geographic Information Systems (GIS) and Global Positioning Systems (GPS) continues to rise.

Technological advancements play a pivotal role in driving the geospatial market forward. The continuous improvement and innovation in satellite technology, remote sensing, and mapping techniques enhance the accuracy and efficiency of geospatial solutions. These advancements not only cater to traditional applications like cartography and urban planning but also open up new opportunities in emerging fields such as precision agriculture, smart cities, and autonomous vehicles. Government initiatives and policies also significantly impact the geospatial market. Many governments recognize the importance of geospatial data in addressing societal challenges and promoting economic growth.

Consequently, there is a growing trend of governments investing in infrastructure development, geospatial data collection, and the implementation of location-based services. These initiatives create a favorable environment for the geospatial market to thrive. The increasing awareness of climate change and its impacts has led to a surge in the use of geospatial technologies for environmental monitoring and management. Organizations and governments worldwide are leveraging geospatial data to monitor deforestation, track changes in land use, and assess the impact of natural disasters. As sustainability becomes a global priority, the geospatial market is positioned to play a crucial role in supporting environmental conservation efforts. Collaboration and partnerships among industry players contribute significantly to the growth of the geospatial market.

With the integration of geospatial data becoming essential in various sectors, collaborations between technology providers, data providers, and end-users foster innovation and the development of comprehensive geospatial solutions. These partnerships enable the creation of synergies that address complex challenges and enhance the overall capabilities of geospatial technologies.

Leave a Comment