Government Initiatives and Investments

Government initiatives and investments in infrastructure development are crucial drivers of the Geographic Information System Market Gi Market. Various governments are increasingly recognizing the importance of GIS in urban planning, disaster management, and environmental monitoring. For instance, substantial funding has been allocated to enhance geospatial data collection and analysis capabilities. This trend is evident in numerous countries where governments are implementing smart city projects that rely heavily on GIS technologies. The investment in GIS not only supports public sector projects but also stimulates private sector growth, as companies align their services with government objectives. Consequently, the Geographic Information System Market Gi Market is poised for growth as these initiatives continue to unfold.

Growing Adoption of Smart Technologies

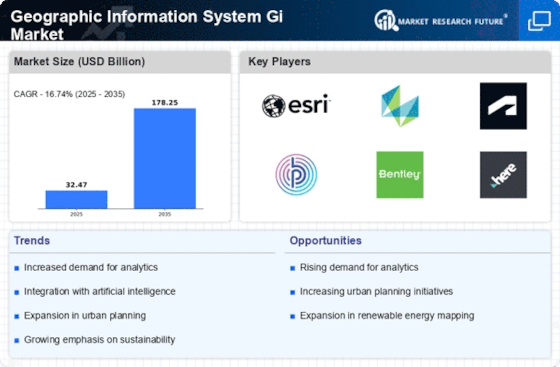

The growing adoption of smart technologies is significantly influencing the Geographic Information System Market Gi Market. As smart devices and IoT applications proliferate, the demand for sophisticated GIS solutions that can process and analyze vast amounts of geospatial data is increasing. This trend is particularly evident in sectors such as agriculture, where precision farming techniques utilize GIS to optimize crop yields and resource management. Market data suggests that the integration of smart technologies with GIS is expected to enhance operational efficiencies and drive innovation. As industries continue to embrace digital transformation, the Geographic Information System Market Gi Market is likely to benefit from the convergence of these technologies, leading to new applications and services.

Increased Demand for Location-Based Services

The rising demand for location-based services is a pivotal driver in the Geographic Information System Market Gi Market. Businesses across various sectors, including retail, transportation, and logistics, are increasingly leveraging GIS technologies to enhance operational efficiency and customer engagement. According to recent data, the market for location-based services is projected to reach substantial figures, indicating a robust growth trajectory. This demand is fueled by the need for precise mapping, navigation, and geospatial analytics, which are integral to decision-making processes. As organizations seek to optimize their resources and improve service delivery, the Geographic Information System Market Gi Market is likely to experience significant expansion, driven by the integration of advanced GIS solutions.

Advancements in Data Analytics and Visualization

Advancements in data analytics and visualization technologies are transforming the Geographic Information System Market Gi Market. The ability to analyze complex geospatial data and present it in an easily interpretable format is becoming increasingly important for decision-makers. Enhanced visualization tools enable organizations to derive actionable insights from GIS data, facilitating better planning and resource allocation. Recent trends indicate that the integration of machine learning and artificial intelligence with GIS is gaining traction, further enhancing analytical capabilities. As businesses and governments seek to harness the power of data-driven decision-making, the Geographic Information System Market Gi Market is likely to witness substantial growth, driven by these technological advancements.

Rising Importance of Environmental Sustainability

The rising importance of environmental sustainability is emerging as a key driver in the Geographic Information System Market Gi Market. Organizations are increasingly utilizing GIS to assess environmental impacts, manage natural resources, and support sustainable development initiatives. This trend is particularly relevant in sectors such as forestry, water management, and urban planning, where GIS plays a vital role in monitoring and mitigating environmental challenges. Market analysis indicates that the demand for GIS solutions that facilitate environmental assessments and compliance with regulations is on the rise. As stakeholders prioritize sustainability, the Geographic Information System Market Gi Market is expected to expand, driven by the need for effective geospatial tools that support eco-friendly practices.