Gene Therapy Size

Gene Therapy Market Growth Projections and Opportunities

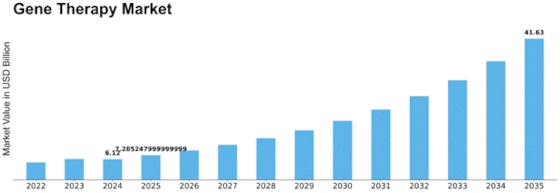

The gene therapy market is expected to reach USD 2.1 billion by 2032 at 6% CAGR from 2023-2032. Many factors form and advance the Gene Therapy Market. One of the main factors is the growing understanding of genetic issues and gene therapy's capacity to treat them. As logic advances, interest in creative genetic disease treatments has grown. Genetic design, delivery, and gene therapy preliminary' positive clinical findings support this trend, demonstrating its potential.

Technical advances in genetic exploration and biotechnology shape the industry. Gene therapy interventions become more accurate, effective, and safe as gene modifying tools, viral vectors, and delivery systems improve. These mechanical advances are expected to expand gene therapy applications, improve treatment outcomes, and prepare for customized genetic medicine, boosting market growth.

Medical care expenditure plans, payback arrangements, and gene treatment cost affect the acceptance of these sophisticated remedies. Gene therapies can be expensive, but medical providers and payers like them because they can reduce dependency on traditional drugs and improve patient outcomes. Financial factors influence market dynamics and gene therapy innovation. The gene therapy business is competitive because biotechnology and pharma companies are experts in genetic medicine. Serious competition drives innovation, with companies developing cures for a variety of genetic disorders, speeding delivery, and improving gene changing technologies. The range of contributions allows doctors to choose gene therapies that meet patient needs, creating a dynamic market.

Medical services sector educational campaigns raise gene therapy awareness among professionals and the public, affecting market factors. Preparing programs, instructional missions, and patient support efforts demonstrate gene therapy's capacity to transform genetic disease treatment, enabling educated decision-making for those considering high-level mediations. These motivations make gene therapy seem promising in modern medicine.

Social attitudes concerning medical services and therapeutic mediations also shape the gene therapy business. Acknowledgement of innovative and high-level medications, morality, and social perception of genetic alteration affect patient preferences and gene therapy consideration. Social factors affect medical service provider-patient communication, creating the gene therapy dynamic cycle.

Medical service foundation and availability vary geologically, adding market factors. Different districts may have different access to cutting-edge gene therapy. To reduce these differences, efforts to improve medical care foundation, raise awareness of therapeutic options, and address financial barriers will affect the global gene therapy business.

Leave a Comment