Digital Transformation

The Gems and jewellery Market is undergoing a significant digital transformation, which is reshaping how consumers engage with brands. E-commerce platforms have become essential for retailers, enabling them to reach a broader audience and enhance customer experience. Recent statistics indicate that online sales in the jewellery sector have increased substantially, with many consumers preferring the convenience of shopping from home. Additionally, social media marketing plays a crucial role in influencing purchasing decisions, as brands leverage platforms to showcase their collections and connect with potential buyers. This digital shift is likely to continue driving growth in the Gems and jewellery Market, as more consumers embrace online shopping.

Increasing Disposable Income

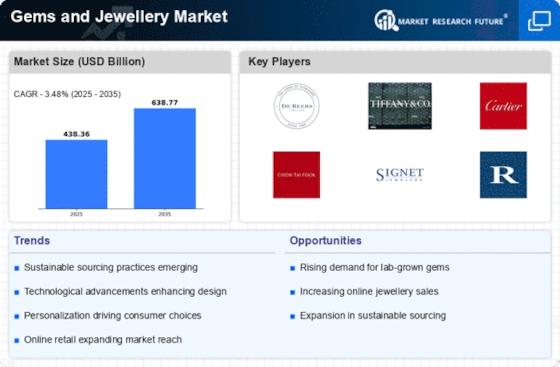

The Gems and jewellery Market appears to be positively influenced by the rising disposable income among consumers. As individuals experience an increase in their earnings, they tend to allocate a portion of their income towards luxury items, including gemstones and jewellery. This trend is particularly evident in emerging economies, where a burgeoning middle class is driving demand for high-quality jewellery. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years, indicating a robust appetite for luxury goods. The Gems and jewellery Market is likely to benefit from this economic uplift, as consumers seek to invest in both personal adornment and status symbols.

Evolving Consumer Preferences

The Gems and jewellery Market is currently witnessing a shift in consumer preferences, with a growing inclination towards unique and personalized pieces. This trend is driven by younger generations who prioritize individuality and self-expression in their purchasing decisions. As a result, brands are increasingly offering customizable options, allowing consumers to create bespoke jewellery that reflects their personal style. Market data suggests that the demand for personalized jewellery has surged, with a notable increase in sales of custom pieces. This evolution in consumer behavior is reshaping the landscape of the Gems and jewellery Market, compelling retailers to adapt their offerings to meet these new expectations.

Cultural Significance of Jewellery

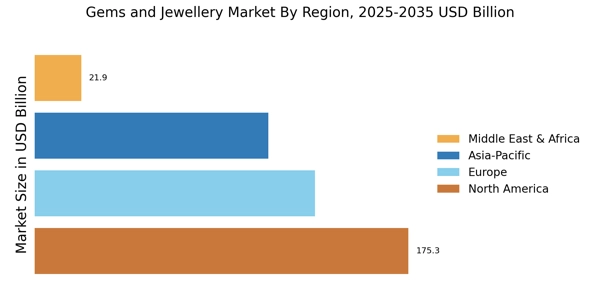

The Gems and jewellery Market is deeply intertwined with cultural traditions and practices across various societies. In many cultures, jewellery serves not only as an adornment but also as a symbol of status, wealth, and heritage. This cultural significance drives demand for specific types of jewellery, such as wedding rings, religious symbols, and heirloom pieces. Market analysis indicates that regions with rich cultural histories tend to have a higher consumption of traditional jewellery, which in turn supports the overall growth of the Gems and jewellery Market. As consumers seek to honor their cultural roots, the demand for culturally relevant jewellery is expected to remain strong.

Sustainability and Ethical Sourcing

The Gems and jewellery Market is increasingly influenced by the growing consumer demand for sustainability and ethical sourcing practices. As awareness of environmental and social issues rises, consumers are more inclined to support brands that prioritize responsible sourcing of materials. This shift is prompting companies to adopt transparent supply chains and sustainable practices, such as using recycled metals and ethically sourced gemstones. Market data suggests that consumers are willing to pay a premium for jewellery that aligns with their values, indicating a potential growth area for the Gems and jewellery Market. This focus on sustainability is likely to shape the future of the industry, as brands strive to meet the expectations of conscientious consumers.