The GCC vitrectomy devices market is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for eye surgeries. Key players such as Alcon (CH), Bausch + Lomb (US), and Carl Zeiss (DE) are at the forefront, each adopting distinct strategies to enhance their market presence. Alcon (CH) focuses on innovation, particularly in developing advanced surgical instruments that improve patient outcomes. Bausch + Lomb (US) emphasizes strategic partnerships to expand its product offerings, while Carl Zeiss (DE) leverages its expertise in imaging technology to enhance surgical precision. Collectively, these strategies contribute to a competitive environment that prioritizes innovation and quality, shaping the market's trajectory.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and improve supply chain efficiency. The market appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they set industry standards and drive technological advancements. This competitive structure fosters an environment where smaller firms must innovate or collaborate to remain relevant.

In December 2025, Alcon (CH) announced the launch of its latest vitrectomy system, which integrates AI technology to assist surgeons in real-time decision-making. This strategic move is likely to enhance surgical outcomes and position Alcon as a leader in the market, as AI integration is becoming a critical differentiator in surgical devices. The introduction of this system may also attract new partnerships with hospitals and surgical centers looking to adopt cutting-edge technology.

In November 2025, Bausch + Lomb (US) entered into a collaboration with a regional healthcare provider to enhance access to its vitrectomy devices across the GCC. This partnership is strategically important as it not only expands Bausch + Lomb's market reach but also aligns with the growing trend of localized healthcare solutions. By working closely with regional entities, the company can better understand and meet the specific needs of the market.

In October 2025, Carl Zeiss (DE) unveiled a new imaging system designed to work seamlessly with its vitrectomy devices, enhancing the precision of surgical procedures. This development underscores the company's commitment to innovation and its focus on integrating advanced imaging technology into surgical workflows. Such advancements are likely to solidify Carl Zeiss's position in the market, as precision becomes increasingly critical in ophthalmic surgeries.

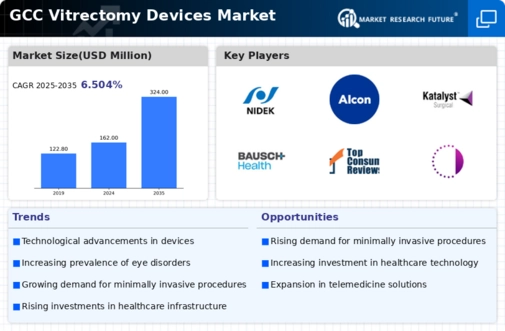

As of January 2026, current trends in the GCC vitrectomy devices market include a strong emphasis on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is expected to evolve, shifting from price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition may redefine how companies position themselves in the market, emphasizing the importance of quality and cutting-edge solutions.