Emergence of 5G Technology

The emergence of 5G technology is poised to have a transformative effect on the virtual cpe market in the GCC. With its promise of ultra-fast data speeds and low latency, 5G is expected to enable a new wave of applications and services that require high-performance network capabilities. This technological advancement is likely to drive the adoption of virtual cpe solutions, as businesses seek to leverage the benefits of 5G for enhanced connectivity and operational efficiency. The virtual cpe market is anticipated to see a substantial increase in demand as organizations prepare for the rollout of 5G networks. Analysts predict that the integration of 5G with virtual cpe solutions could lead to a market expansion of approximately 25% over the next few years.

Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver for the virtual cpe market, particularly in the GCC region where businesses are under pressure to optimize their operational expenditures. The shift towards virtualized solutions allows organizations to minimize capital expenditures associated with physical hardware while also reducing maintenance costs. As companies increasingly recognize the financial benefits of adopting virtual cpe solutions, the market is likely to witness accelerated growth. Reports indicate that organizations can achieve up to 30% savings in operational costs by transitioning to virtual cpe systems. This focus on cost efficiency is expected to propel the virtual cpe market forward, as more enterprises seek to leverage these solutions to enhance their financial performance.

Growing Importance of Network Security

The virtual cpe market is being significantly impacted by the growing importance of network security in the GCC. As cyber threats become more sophisticated, organizations are prioritizing the implementation of robust security measures within their network infrastructures. Virtual cpe solutions offer enhanced security features, such as integrated firewalls and intrusion detection systems, which are essential for safeguarding sensitive data. The increasing frequency of cyberattacks has prompted businesses to invest in advanced security solutions, thereby driving demand for virtual cpe offerings. It is estimated that the market for network security solutions within the virtual cpe market could grow by over 20% in the coming years, reflecting the critical need for secure network environments.

Rising Demand for Flexible Network Solutions

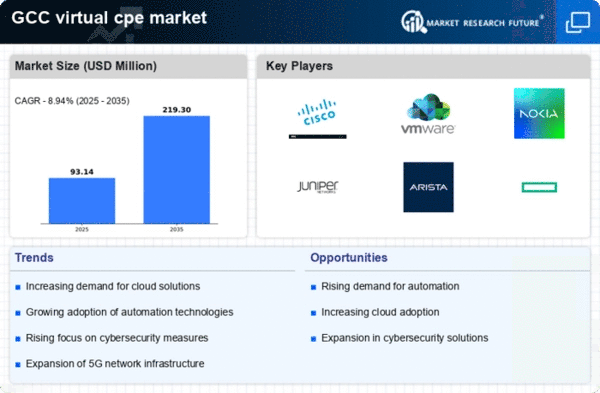

The virtual cpe market is experiencing a notable surge in demand for flexible network solutions across the GCC region. Organizations are increasingly seeking to enhance their operational efficiency and reduce costs, which has led to a shift from traditional hardware-based systems to virtualized solutions. This transition allows for greater scalability and adaptability, enabling businesses to respond swiftly to changing market conditions. According to recent data, the virtual cpe market in the GCC is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for agile network infrastructures that can support diverse applications and services, thereby fostering innovation and competitiveness within the industry.

Government Initiatives Supporting Digital Transformation

Government initiatives aimed at promoting digital transformation are significantly influencing the virtual cpe market in the GCC. Various national strategies are being implemented to enhance the region's technological landscape, which includes investments in digital infrastructure and support for innovative technologies. For instance, the UAE's Vision 2021 and Saudi Arabia's Vision 2030 emphasize the importance of adopting advanced technologies to drive economic diversification. These initiatives are likely to create a conducive environment for the virtual cpe market, as businesses align their strategies with government objectives. The anticipated growth in public sector investments is expected to bolster the adoption of virtual cpe solutions, thereby enhancing the overall market landscape.