Advancements in Technology

Technological advancements are significantly influencing the synthetic data-generation market. Innovations in algorithms and computing power are enabling the creation of more sophisticated synthetic datasets that closely resemble real-world data. This is particularly relevant in sectors such as finance and healthcare, where accurate data representation is crucial. The GCC region is witnessing increased investment in research and development, which is likely to enhance the capabilities of synthetic data tools. As a result, organizations are more inclined to adopt these technologies, leading to a projected market growth of around 30% by 2026, as they seek to leverage advanced data solutions for better decision-making.

Rising Demand for Data Privacy

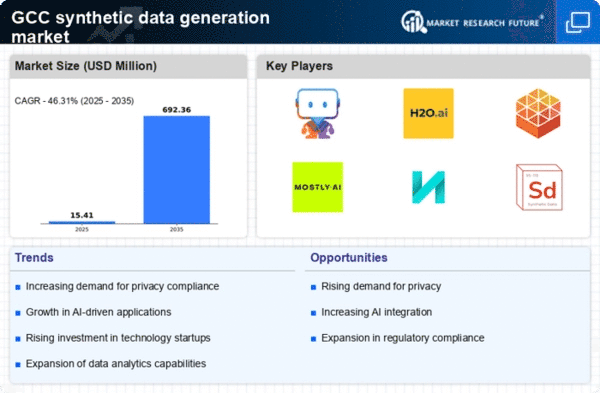

The synthetic data-generation market is experiencing a notable surge in demand for enhanced data privacy measures. As organizations in the GCC region increasingly prioritize data protection, the need for synthetic data solutions that can mimic real datasets without compromising sensitive information becomes paramount. This trend is driven by stringent data protection regulations, which necessitate the use of synthetic data to ensure compliance while still enabling data-driven insights. The market is projected to grow at a CAGR of approximately 25% over the next five years, reflecting the urgency for businesses to adopt innovative data solutions that safeguard privacy while maintaining analytical capabilities.

Emerging Applications Across Industries

The synthetic data-generation market is witnessing a diversification of applications across various industries. Sectors such as finance, healthcare, and retail are increasingly adopting synthetic data for purposes ranging from fraud detection to customer behavior analysis. This trend is fueled by the need for organizations to leverage data-driven insights while mitigating risks associated with real data usage. In the GCC, the expansion of digital transformation initiatives is likely to further propel the adoption of synthetic data solutions. As a result, the market is projected to experience a growth rate of around 22% over the next few years, reflecting the broadening scope of synthetic data applications.

Growing Need for Cost-Effective Solutions

The synthetic data-generation market is being driven by the growing need for cost-effective data solutions. Traditional data collection methods can be resource-intensive and time-consuming, particularly in industries such as retail and telecommunications. Synthetic data offers a viable alternative, allowing organizations to generate large volumes of data without the associated costs of data acquisition. In the GCC, where businesses are increasingly focused on optimizing operational efficiency, the adoption of synthetic data solutions is expected to rise. This shift could lead to a market expansion of approximately 20% over the next few years, as companies seek to balance budget constraints with the need for robust data analytics.

Increased Focus on AI and Machine Learning

The synthetic data-generation market is closely linked to the growing emphasis on artificial intelligence (AI) and machine learning (ML) applications. As organizations in the GCC strive to harness the power of AI, the demand for high-quality training data becomes critical. Synthetic data serves as an effective solution, providing diverse datasets that can enhance the performance of AI models. This trend is particularly evident in sectors such as automotive and smart cities, where AI-driven innovations are rapidly evolving. The market is anticipated to grow by approximately 28% in the coming years, as businesses recognize the value of synthetic data in improving AI outcomes.