Rising Surgical Procedures

The GCC Surgical Drapes And Gowns Market is significantly influenced by the increasing number of surgical procedures being performed in the region. With a growing population and rising prevalence of chronic diseases, the demand for surgical interventions is on the rise. For example, the number of surgeries in the UAE is expected to increase by 10% annually, leading to a higher consumption of surgical drapes and gowns. This trend is further supported by the expansion of healthcare facilities and the establishment of specialized surgical centers. As the volume of surgeries escalates, the need for high-quality surgical textiles becomes paramount, thereby driving the growth of the market. The emphasis on patient safety and infection control during surgical procedures also necessitates the use of reliable surgical drapes and gowns.

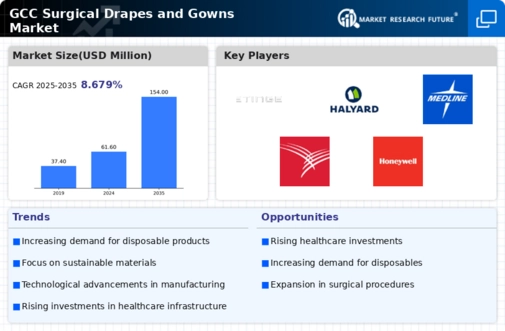

Increasing Healthcare Expenditure

The GCC Surgical Drapes And Gowns Market is experiencing growth due to rising healthcare expenditure across the region. Governments in GCC countries are investing significantly in healthcare infrastructure, which includes the procurement of surgical drapes and gowns. For instance, the healthcare spending in Saudi Arabia is projected to reach USD 50 billion by 2026, indicating a robust demand for surgical products. This increase in funding is likely to enhance the quality of healthcare services, thereby driving the need for high-quality surgical drapes and gowns. Furthermore, as healthcare facilities expand, the requirement for surgical textiles is expected to rise, contributing to the overall growth of the market. The focus on improving patient outcomes and safety standards further propels the demand for advanced surgical drapes and gowns.

Government Regulations and Standards

The GCC Surgical Drapes And Gowns Market is shaped by stringent government regulations and standards aimed at ensuring the safety and efficacy of surgical products. Regulatory bodies in GCC countries are implementing guidelines that mandate the use of certified surgical drapes and gowns in healthcare settings. Compliance with these regulations is crucial for manufacturers and suppliers, as it directly impacts market access and competitiveness. For instance, the Saudi Food and Drug Authority (SFDA) has established specific standards for surgical textiles, which manufacturers must adhere to. This regulatory environment not only enhances product quality but also fosters consumer confidence in surgical products. As healthcare providers strive to meet these standards, the demand for compliant surgical drapes and gowns is likely to increase, thereby propelling market growth.

Growing Awareness of Infection Control

The GCC Surgical Drapes And Gowns Market is benefiting from the growing awareness of infection control practices among healthcare professionals. As hospitals and surgical centers prioritize patient safety, the demand for high-quality surgical drapes and gowns that minimize the risk of infections is increasing. Educational initiatives and training programs focused on infection prevention are being implemented across the region, further emphasizing the importance of using appropriate surgical textiles. The market is likely to see a rise in the adoption of advanced drapes and gowns that offer superior protection against contaminants. This heightened awareness not only drives demand but also encourages manufacturers to innovate and improve their product offerings, thereby contributing to the overall growth of the surgical drapes and gowns market in the GCC.

Technological Advancements in Materials

The GCC Surgical Drapes And Gowns Market is witnessing a surge in demand due to technological advancements in materials used for surgical textiles. Innovations in fabric technology, such as the development of antimicrobial and fluid-resistant materials, are enhancing the performance of surgical drapes and gowns. These advancements not only improve patient safety but also reduce the risk of infections during surgical procedures. The introduction of smart textiles that can monitor patient conditions is also gaining traction. As hospitals and surgical centers in the GCC region adopt these advanced materials, the market for surgical drapes and gowns is likely to expand. The integration of technology into surgical textiles aligns with the region's vision to modernize healthcare services, thereby fostering growth in the industry.