Increased Focus on Fan Engagement

In the sports analytics market, enhancing fan engagement has become a critical driver of growth. Organizations are utilizing analytics to understand fan behavior and preferences, allowing them to tailor experiences and improve satisfaction. In the GCC, sports franchises are investing in analytics solutions that provide insights into ticket sales, merchandise purchases, and social media interactions. This data-driven approach is expected to increase fan loyalty and attendance at events, with projections indicating that fan engagement initiatives could boost revenues by up to 15% in the coming years. As a result, the sports analytics market is likely to benefit from this heightened focus on fan engagement.

Emergence of Data-Driven Decision Making

The shift towards data-driven decision making is transforming the landscape of the sports analytics market. Teams and organizations are increasingly relying on analytics to inform strategic decisions, from player recruitment to game tactics. In the GCC, this trend is evident as clubs adopt sophisticated analytics platforms to gain insights into player performance and opponent strategies. The market for sports analytics solutions is projected to grow significantly, with estimates suggesting a potential increase of 30% in adoption rates over the next few years. This emphasis on data-driven approaches is likely to reshape how sports organizations operate, further propelling the growth of the sports analytics market.

Government Support for Sports Development

Government initiatives aimed at promoting sports development in the GCC are playing a pivotal role in the growth of the sports analytics market. Various national sports programs are being established, which often include the integration of analytics to track athlete progress and improve training methodologies. For instance, the UAE government has allocated substantial funding for sports infrastructure and technology, which is expected to enhance the capabilities of local teams and athletes. This support is likely to foster innovation in the sports analytics market, as organizations seek to align with government objectives and leverage analytics for better outcomes.

Expansion of E-Sports and Gaming Analytics

The rise of e-sports has significantly impacted the sports analytics market, particularly in the GCC region. With the increasing popularity of competitive gaming, there is a growing need for analytics tools that can assess player performance and game strategies. This segment is expected to witness substantial growth, with market analysts estimating that the e-sports analytics market could reach $1 billion by 2026. The integration of analytics in e-sports not only enhances player performance but also provides valuable insights for teams and sponsors, thereby contributing to the overall expansion of the sports analytics market.

Growing Demand for Performance Optimization

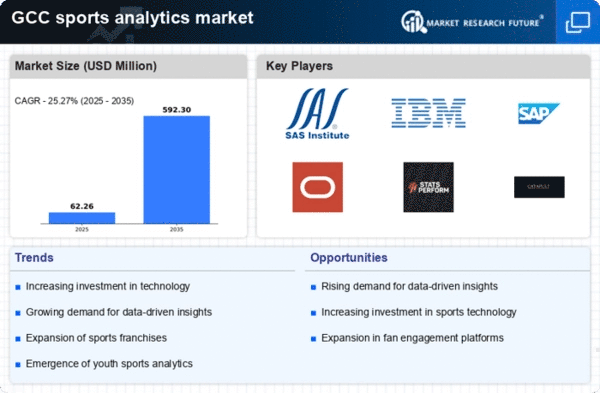

The sports analytics market is experiencing a notable surge in demand for performance optimization tools. Teams and athletes are increasingly leveraging data-driven insights to enhance training regimens and improve overall performance. In the GCC, the focus on sports excellence has led to investments in analytics solutions that provide real-time feedback and performance metrics. This trend is reflected in the increasing adoption of analytics platforms, which are projected to grow at a CAGR of approximately 25% over the next five years. As organizations seek to gain a competitive edge, the emphasis on performance optimization is likely to drive further growth in the sports analytics market.