Growing Awareness of Sleep Health

There is a notable increase in public awareness regarding the importance of sleep health in the GCC. Campaigns promoting the benefits of good sleep hygiene and the risks associated with untreated sleep disorders are gaining traction. This heightened awareness is driving individuals to seek professional help, thereby increasing the demand for sleep testing services. The sleep testing-services market is likely to benefit from this trend, with estimates suggesting a potential growth of 12% in service utilization as more people recognize the need for proper diagnosis and treatment. Educational initiatives by healthcare providers are crucial in sustaining this momentum.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in the GCC are significantly impacting the sleep testing-services market. Various health ministries are allocating funds to enhance diagnostic capabilities for sleep disorders. For instance, initiatives to establish specialized sleep centers and training programs for healthcare professionals are underway. Such investments are expected to bolster the availability and quality of sleep testing services. The market could see an increase in funding by approximately 20% as governments prioritize sleep health as part of their public health agendas. This proactive approach is likely to foster innovation and improve patient outcomes in the sleep testing-services market.

Integration of Telehealth Services

The integration of telehealth services into the healthcare framework in the GCC is transforming the sleep testing-services market. Telehealth offers patients convenient access to sleep specialists, enabling remote consultations and follow-ups. This shift is particularly beneficial in a region where access to healthcare can be limited in rural areas. The convenience of telehealth is likely to increase patient engagement and adherence to sleep testing protocols. As a result, the market may witness a surge in demand for remote sleep testing solutions, with projections suggesting a potential increase in market size by 15% over the next few years. This integration not only enhances patient experience but also streamlines the testing process.

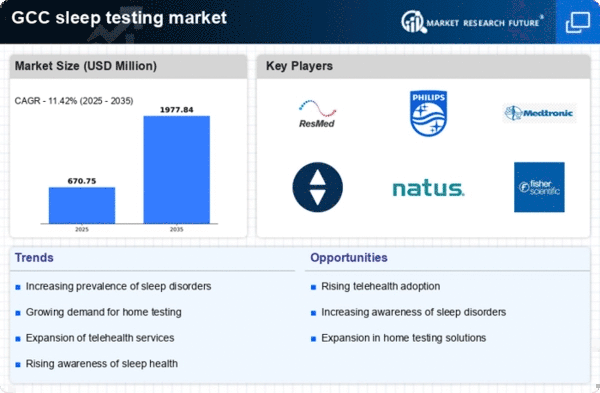

Rising Prevalence of Sleep Disorders

The increasing incidence of sleep disorders in the GCC region is a primary driver for the sleep testing-services market. Studies indicate that approximately 30% of the population experiences some form of sleep-related issues, such as insomnia or sleep apnea. This growing prevalence necessitates enhanced diagnostic services, thereby propelling demand for sleep testing. As healthcare providers recognize the importance of early detection and treatment, investments in sleep testing technologies are likely to rise. The sleep testing-services market is expected to expand as healthcare systems adapt to these needs, potentially leading to a market growth rate of around 10% annually. This trend underscores the critical role of sleep testing in managing public health effectively.

Advancements in Sleep Testing Technology

Technological advancements in sleep testing equipment and methodologies are revolutionizing the sleep testing-services market. Innovations such as portable sleep monitors and advanced polysomnography systems are making it easier for patients to undergo testing in various settings, including their homes. These advancements not only enhance the accuracy of diagnoses but also improve patient comfort and compliance. The market is expected to experience a growth rate of around 18% as new technologies are adopted. As healthcare providers increasingly leverage these innovations, the overall efficiency and effectiveness of sleep testing services are likely to improve, further driving market expansion.