Government Initiatives and Funding

Government initiatives aimed at improving public health are significantly influencing the sleep testing-services market. The UK government has recognized the importance of addressing sleep disorders as part of its broader health strategy. Increased funding for sleep research and public health campaigns is likely to enhance the availability of testing services. For instance, initiatives that promote awareness and early diagnosis of sleep apnea are expected to lead to a higher uptake of sleep testing services. This proactive approach not only benefits patients but also alleviates the burden on the healthcare system, making it a vital driver for the market.

Rising Awareness of Sleep Disorders

The increasing awareness of sleep disorders among the UK population is a pivotal driver for the sleep testing-services market. As more individuals recognize the impact of sleep-related issues on overall health, the demand for diagnostic services is likely to rise. Reports indicate that approximately 30% of adults in the UK experience sleep disturbances, prompting a greater need for effective testing solutions. This heightened awareness is further fueled by educational campaigns and healthcare initiatives aimed at promoting better sleep hygiene. Consequently, healthcare providers are expanding their offerings in the sleep testing-services market to cater to this growing demand, thereby enhancing accessibility and affordability of testing services.

Technological Advancements in Sleep Monitoring

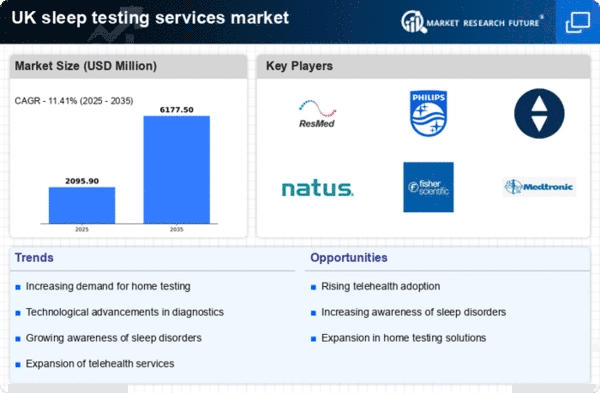

Technological advancements play a crucial role in shaping the sleep testing-services market. Innovations such as wearable devices and mobile applications have transformed how sleep disorders are diagnosed and monitored. These technologies enable patients to track their sleep patterns in real-time, providing valuable data for healthcare professionals. The integration of artificial intelligence in sleep diagnostics is also emerging, allowing for more accurate assessments and personalized treatment plans. As these technologies become more prevalent, the market is expected to witness a surge in demand for sleep testing services, with an estimated growth rate of 15% annually over the next five years.

Aging Population and Associated Health Concerns

The aging population in the UK presents a significant driver for the sleep testing-services market. As individuals age, they are more susceptible to various health issues, including sleep disorders. Research indicates that approximately 50% of older adults experience sleep disturbances, which can exacerbate other health conditions. This demographic shift necessitates an increase in sleep testing services tailored to the needs of older patients. Healthcare providers are likely to expand their offerings to accommodate this growing segment, thereby enhancing the overall market landscape. The focus on geriatric care and the management of sleep disorders is expected to drive substantial growth in the coming years.

Growing Prevalence of Lifestyle-Related Sleep Issues

The growing prevalence of lifestyle-related sleep issues is a notable driver for the sleep testing-services market. Factors such as increased screen time, sedentary lifestyles, and high-stress levels contribute to sleep disorders among the UK population. Studies suggest that nearly 40% of adults report insufficient sleep due to these lifestyle choices. As awareness of the consequences of poor sleep quality rises, individuals are more inclined to seek professional help. This trend is likely to propel the demand for sleep testing services, as healthcare providers adapt to the changing needs of patients seeking solutions for their sleep-related challenges.