Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the GCC real time PCR qPCR market. Various GCC countries are implementing policies to enhance healthcare systems and promote the adoption of advanced diagnostic technologies. For example, Saudi Arabia's Vision 2030 emphasizes the importance of healthcare innovation, leading to increased investments in molecular diagnostics. Such initiatives not only improve healthcare access but also stimulate the growth of the real time PCR qPCR market. The allocation of funds for research and development in this sector is likely to result in the introduction of new products and technologies, thereby expanding the GCC real time PCR qPCR market.

Expansion of Diagnostic Laboratories

The expansion of diagnostic laboratories across the GCC region is a key driver for the real time PCR qPCR market. With the increasing demand for accurate and timely diagnostic services, many countries are investing in the establishment of state-of-the-art laboratories equipped with advanced technologies. For instance, Qatar has seen a rise in the number of accredited laboratories that utilize real time PCR qPCR methods for various applications, including infectious disease testing and genetic analysis. This growth in laboratory infrastructure is likely to enhance the availability of real time PCR qPCR services, thereby contributing to the overall expansion of the GCC real time PCR qPCR market. As more laboratories adopt these technologies, the market is expected to witness a robust growth trajectory.

Growing Awareness of Genetic Testing

The GCC real time PCR qPCR market is benefiting from the growing awareness of genetic testing among healthcare professionals and patients. As individuals become more informed about the benefits of genetic testing for disease prevention and personalized treatment, the demand for real time PCR qPCR technologies is expected to rise. Educational campaigns and collaborations between healthcare providers and diagnostic companies are enhancing understanding of the importance of molecular diagnostics. This trend is likely to lead to increased adoption of real time PCR qPCR solutions in clinical settings, thereby driving growth in the GCC real time PCR qPCR market. The market is projected to expand as more healthcare facilities integrate these technologies into their diagnostic workflows.

Rising Incidence of Infectious Diseases

The GCC real time PCR qPCR market is significantly influenced by the rising incidence of infectious diseases. The region has witnessed an increase in cases of viral and bacterial infections, necessitating rapid and accurate diagnostic methods. Real time PCR technology is favored for its ability to provide quick results, which is crucial for effective disease management. According to health statistics, the prevalence of infectious diseases in the GCC has prompted healthcare providers to adopt advanced diagnostic tools, thereby driving demand in the real time PCR qPCR market. This trend is expected to continue, as public health initiatives focus on early detection and containment of outbreaks, further propelling the growth of the GCC real time PCR qPCR market.

Increasing Research and Development Activities

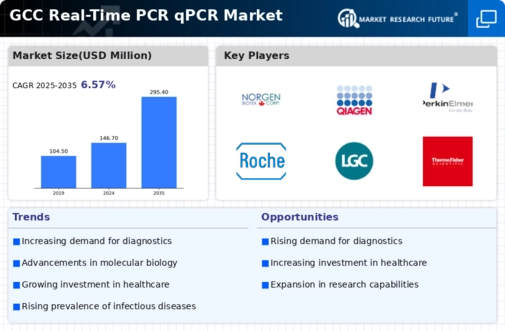

The GCC real time PCR qPCR market is experiencing a surge in research and development activities, driven by the need for advanced diagnostic tools. Governments in the region are investing heavily in biotechnology and life sciences, with initiatives aimed at enhancing research capabilities. For instance, the UAE has established several research centers focusing on genomics and molecular biology, which are pivotal for the growth of the real time PCR qPCR market. This influx of funding and resources is likely to foster innovation, leading to the development of more efficient and accurate diagnostic solutions. As a result, the GCC real time PCR qPCR market is poised for significant growth, with an expected compound annual growth rate (CAGR) of around 8% over the next five years.