Rising Health Awareness

There is a notable increase in health awareness among the population in the GCC, which serves as a crucial driver for the mhealth applications market. As individuals become more conscious of their health and wellness, the demand for mobile health solutions is expected to grow. This trend is reflected in the rising interest in preventive healthcare and lifestyle management, with many users seeking applications that provide personalized health insights and recommendations. The mhealth applications market is likely to benefit from this shift, as users increasingly turn to technology for health monitoring and management. Moreover, educational campaigns and health programs initiated by governments and organizations are further promoting the use of mhealth applications, potentially leading to a more health-conscious society.

Increasing Smartphone Penetration

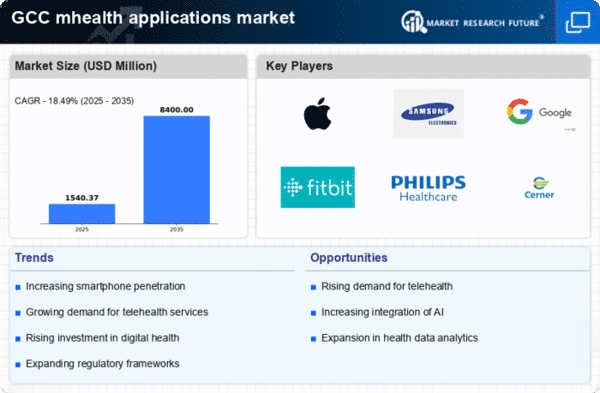

The proliferation of smartphones in the GCC region is a pivotal driver for the mhealth applications market. As of 2025, smartphone penetration in the GCC is estimated to exceed 90%, facilitating access to mobile health solutions. This widespread adoption enables users to engage with health applications for monitoring, consultations, and wellness management. The convenience of mobile devices allows for real-time health tracking and communication with healthcare providers, which is particularly beneficial in remote areas. Furthermore, the increasing availability of affordable smartphones is likely to expand the user base, thereby enhancing the growth potential of the mhealth applications market. As more individuals utilize smartphones, the demand for innovative health solutions is expected to rise, creating opportunities for developers and healthcare providers alike.

Government Initiatives and Support

Government initiatives in the GCC region are significantly influencing the mhealth applications market. Various national health strategies emphasize the integration of technology in healthcare, aiming to improve health outcomes and accessibility. For instance, investments in digital health infrastructure and regulatory frameworks are being established to support the development of mhealth applications. The GCC governments are also promoting public-private partnerships to foster innovation in health technology. As a result, funding for mhealth projects is increasing, which could lead to the creation of more user-friendly and effective applications. This supportive environment is likely to accelerate the adoption of mhealth solutions, ultimately enhancing the overall healthcare landscape in the region.

Focus on Chronic Disease Management

The growing prevalence of chronic diseases in the GCC region is driving demand for mhealth applications focused on disease management. With conditions such as diabetes, hypertension, and obesity on the rise, there is an increasing need for mobile solutions that assist patients in managing their health effectively. The mhealth applications market is responding to this need by offering tools for monitoring vital signs, medication adherence, and lifestyle modifications. As healthcare providers recognize the potential of mhealth applications in improving patient outcomes, partnerships between tech companies and healthcare institutions are likely to increase. This focus on chronic disease management not only enhances patient engagement but also contributes to the overall sustainability of healthcare systems in the GCC.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into mhealth applications is emerging as a transformative driver in the GCC market. AI technologies enable personalized health recommendations, predictive analytics, and enhanced user engagement, which can significantly improve health outcomes. As of 2025, the adoption of AI in healthcare is projected to grow, with many mhealth applications incorporating machine learning algorithms to analyze user data and provide tailored insights. This technological advancement not only enhances the functionality of health applications but also increases user satisfaction and retention. Consequently, the mhealth applications market is likely to experience accelerated growth as developers leverage AI to create innovative solutions that meet the evolving needs of users.