Rising Demand for Automation

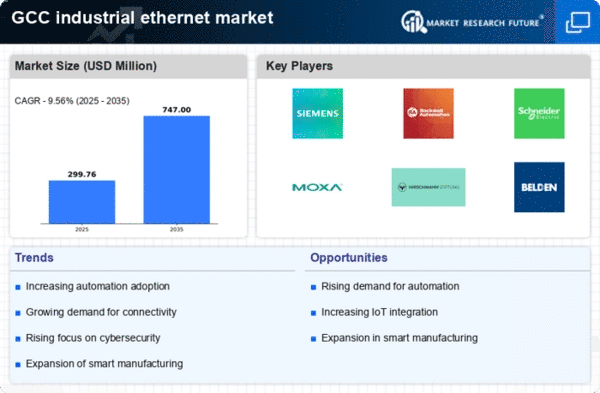

The industrial ethernet market is experiencing a notable surge in demand for automation across various sectors in the GCC. Industries are increasingly adopting automated solutions to enhance operational efficiency and reduce human error. This trend is driven by the need for real-time data processing and communication, which industrial ethernet facilitates effectively. According to recent estimates, the automation sector in the GCC is projected to grow at a CAGR of approximately 10% over the next five years. This growth is likely to propel the industrial ethernet market, as more companies seek to integrate advanced networking solutions to support their automation initiatives.

Growing Focus on Data Analytics

The industrial ethernet market is being significantly influenced by the growing emphasis on data analytics within the GCC. Companies are increasingly recognizing the value of data-driven decision-making, which necessitates the deployment of high-speed, reliable networking solutions. Industrial ethernet provides the necessary infrastructure to support large volumes of data transmission and analysis. Recent reports indicate that the data analytics market in the GCC is expected to reach $1 billion by 2026, suggesting a strong correlation with the industrial ethernet market. As organizations strive to leverage data for competitive advantage, the demand for industrial ethernet solutions is likely to rise.

Expansion of Smart Manufacturing

Smart manufacturing is becoming a pivotal driver for the industrial ethernet market in the GCC. The integration of advanced technologies such as AI, machine learning, and IoT is transforming traditional manufacturing processes into smart, interconnected systems. This shift is expected to enhance productivity and reduce operational costs significantly. The GCC region is witnessing substantial investments in smart manufacturing initiatives, with funding reaching upwards of $5 billion in recent years. As manufacturers adopt these technologies, the demand for robust and reliable industrial ethernet solutions is likely to increase, further solidifying its role in the industrial ethernet market.

Emphasis on Enhanced Connectivity

The industrial ethernet market is witnessing a heightened emphasis on enhanced connectivity solutions in the GCC. As industries evolve, the need for seamless communication between devices and systems becomes increasingly critical. Industrial ethernet offers the high-speed connectivity required for real-time data exchange and operational efficiency. Recent surveys suggest that over 70% of companies in the GCC are prioritizing connectivity improvements in their operational strategies. This trend indicates a growing recognition of the importance of reliable networking solutions, which is likely to drive further growth in the industrial ethernet market.

Increased Investment in Infrastructure

Investment in infrastructure development is a critical driver for the industrial ethernet market in the GCC. Governments in the region are prioritizing infrastructure projects to support economic diversification and growth. This includes the establishment of smart cities and advanced industrial zones, which require robust networking solutions. Recent government reports indicate that infrastructure spending in the GCC is projected to exceed $200 billion over the next five years. Such investments are expected to create a favorable environment for the industrial ethernet market, as companies seek to implement reliable networking systems to support these ambitious projects.