Rising Demand for Outsourced Services

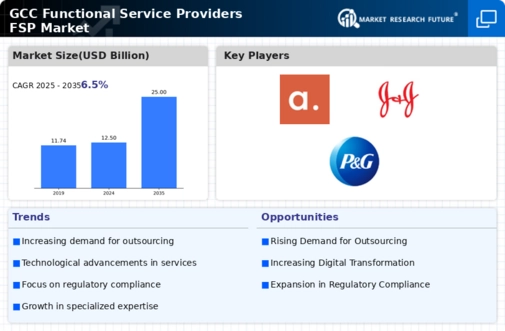

The GCC functional service providers market is experiencing a growing trend towards outsourcing various healthcare services. Organizations are increasingly recognizing the benefits of outsourcing non-core functions, such as clinical research and regulatory affairs, to specialized providers. This trend is driven by the need to reduce operational costs and improve service quality. According to recent estimates, the outsourcing market in the GCC is expected to grow by 20% annually, reflecting a shift in how healthcare organizations approach service delivery. As a result, functional service providers are likely to see increased demand for their expertise, further propelling the growth of the GCC functional service providers market.

Increased Focus on Patient-Centric Care

The GCC functional service providers market is witnessing a paradigm shift towards patient-centric care. This trend is largely influenced by the growing awareness of patient rights and the need for personalized healthcare solutions. As healthcare providers strive to enhance patient experiences, functional service providers are increasingly called upon to deliver tailored services that meet specific patient needs. This shift is expected to drive the demand for innovative solutions, such as telemedicine and remote monitoring, which are projected to grow at a compound annual growth rate of 15% in the coming years. Consequently, the GCC functional service providers market is likely to adapt by integrating these technologies into their service delivery models.

Regulatory Reforms and Compliance Requirements

The GCC functional service providers market is significantly influenced by ongoing regulatory reforms aimed at enhancing compliance and safety standards. Governments in the region are implementing stringent regulations to ensure that healthcare services meet international standards. For instance, the introduction of the GCC Unified Health System aims to standardize healthcare practices across member states. This regulatory landscape creates opportunities for functional service providers to offer compliance-related services, such as auditing and training. As the market adapts to these reforms, the demand for expertise in navigating complex regulatory environments is expected to rise, thereby bolstering the growth of the GCC functional service providers market.

Technological Advancements in Service Delivery

The GCC functional service providers market is increasingly shaped by technological advancements that enhance service delivery. Innovations such as artificial intelligence, big data analytics, and cloud computing are transforming how functional service providers operate. These technologies enable providers to streamline processes, improve data management, and enhance decision-making capabilities. For example, the adoption of AI in clinical trials is projected to reduce the time required for drug development by up to 30%. As a result, the integration of these technologies is likely to drive efficiency and effectiveness within the GCC functional service providers market, positioning providers to better meet the evolving needs of clients.

Growing Investment in Healthcare Infrastructure

The GCC functional service providers market is experiencing a notable surge in investment, particularly in healthcare infrastructure. Governments across the region are prioritizing the enhancement of healthcare facilities, which is expected to reach a value of USD 100 billion by 2025. This investment is driven by the need to improve healthcare access and quality, thereby creating a favorable environment for functional service providers. As a result, the demand for specialized services, such as clinical trials and regulatory affairs, is likely to increase. Furthermore, the establishment of public-private partnerships is anticipated to facilitate the growth of the GCC functional service providers market, enabling providers to expand their service offerings and enhance operational efficiencies.