Focus on Energy Efficiency

Energy efficiency has become a critical consideration in The FPGA in Telecom Sector, particularly as telecom operators seek to reduce operational costs and environmental impact. FPGAs are recognized for their ability to deliver high performance while consuming less power compared to traditional hardware solutions. This characteristic is increasingly important in the GCC, where energy costs can be substantial. As telecom companies prioritize sustainability, the demand for energy-efficient solutions is likely to rise. Recent studies suggest that implementing FPGAs can lead to energy savings of up to 30%, making them an attractive option for operators looking to optimize their networks. This focus on energy efficiency is expected to propel the growth of the fpga in-telecom-sector market.

Emergence of IoT Applications

The rise of Internet of Things (IoT) applications is significantly influencing The FPGA in Telecom Sector. As more devices become interconnected, the demand for robust and efficient communication protocols increases. FPGAs offer the versatility needed to support various IoT applications, from smart cities to industrial automation. The GCC region is witnessing a rapid increase in IoT deployments, with projections indicating that the number of connected devices could reach 50 million by 2026. This growth presents a substantial opportunity for the fpga in-telecom-sector market, as FPGAs can facilitate the development of scalable and adaptable solutions that cater to the diverse needs of IoT ecosystems.

Expansion of Telecom Infrastructure

The ongoing expansion of telecom infrastructure across the GCC is a significant driver for The FPGA in Telecom Sector. Governments in the region are investing heavily in enhancing their telecommunications networks to support economic growth and digital transformation initiatives. This expansion includes the deployment of new base stations, fiber optic networks, and data centers, all of which require advanced hardware solutions. FPGAs play a crucial role in this infrastructure development by enabling rapid prototyping and deployment of new technologies. As a result, the fpga in-telecom-sector market is expected to see increased adoption, with estimates suggesting a market growth of around 20% over the next five years, driven by infrastructure investments.

Rising Demand for High-Speed Connectivity

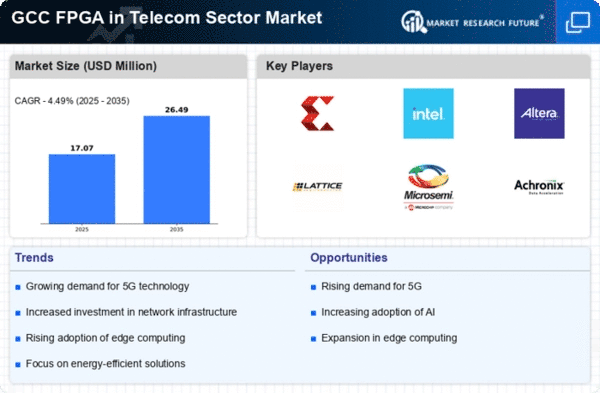

The fpga in-telecom-sector market is experiencing a notable surge in demand for high-speed connectivity solutions. This is primarily driven by the increasing need for faster data transmission rates, particularly in urban areas where population density is high. As telecom operators strive to enhance their service offerings, the integration of FPGAs allows for the development of advanced networking equipment capable of supporting higher bandwidths. Recent data indicates that the GCC region is projected to witness a compound annual growth rate (CAGR) of approximately 15% in the adoption of high-speed internet services. Consequently, The FPGA in Telecom Sector is likely to benefit from this trend, as FPGAs provide the necessary flexibility and performance to meet the evolving demands of telecom infrastructure.

Shift Towards Virtualized Network Functions

The shift towards virtualized network functions (VNF) is reshaping the landscape of The FPGA in Telecom Sector. Telecom operators are increasingly adopting virtualization to enhance operational efficiency and reduce costs. FPGAs are well-suited for this transition, as they can accelerate data processing and improve the performance of virtualized applications. The GCC telecom sector is expected to see a significant increase in VNF adoption, with estimates suggesting a growth rate of 25% over the next few years. This trend indicates a growing reliance on FPGAs to support the deployment of virtualized services, thereby driving the fpga in-telecom-sector market forward.