Rising Environmental Awareness

Rising environmental awareness among consumers is a key driver of the electric vehicle-ev-insurance market. As individuals become more conscious of their carbon footprint, there is a growing preference for electric vehicles, which are perceived as a more sustainable alternative to traditional combustion engine vehicles. In the GCC, where environmental concerns are increasingly prioritized, this shift in consumer behavior is likely to lead to a surge in electric vehicle sales. Consequently, the demand for insurance products that cater specifically to electric vehicles is expected to rise. Insurers may respond by developing policies that not only cover the vehicles but also promote eco-friendly practices, thereby aligning with the values of environmentally conscious consumers.

Consumer Demand for Customization

Consumer demand for customization is emerging as a significant driver in the electric vehicle-ev-insurance market. As electric vehicle owners seek personalized insurance solutions that cater to their unique needs, insurers are prompted to innovate their offerings. This trend is particularly evident in the GCC, where consumers are increasingly looking for coverage options that reflect their lifestyle and driving habits. Insurers may respond by providing flexible policies that allow for adjustments based on individual preferences, such as mileage limits or coverage for specific electric vehicle features. This shift towards customization not only enhances customer satisfaction but also fosters loyalty, thereby contributing to the growth of the electric vehicle-ev-insurance market.

Government Incentives and Policies

The electric vehicle-ev-insurance market is significantly influenced by government incentives and policies aimed at promoting electric vehicle adoption. In the GCC, various governments have introduced initiatives such as tax exemptions, rebates, and subsidies for electric vehicle purchases. For instance, the UAE has implemented a 100% exemption on registration fees for electric vehicles, which encourages consumers to transition from traditional vehicles. These policies not only stimulate demand for electric vehicles but also create a corresponding need for specialized insurance products tailored to this market. As electric vehicle ownership rises, insurers are likely to adapt their offerings to meet the unique needs of electric vehicle owners, thereby driving growth in the electric vehicle-ev-insurance market.

Technological Advancements in Electric Vehicles

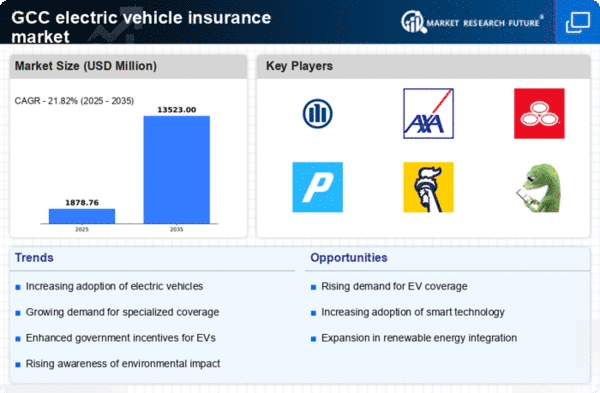

Technological advancements in electric vehicles are reshaping the electric vehicle-ev-insurance market. Innovations such as improved battery technology, enhanced safety features, and autonomous driving capabilities are making electric vehicles more appealing to consumers. In the GCC, the market for electric vehicles is projected to grow at a CAGR of approximately 20% over the next five years, driven by these advancements. As electric vehicles become more sophisticated, insurance providers may need to develop new policies that account for the unique risks associated with these technologies. This evolution in vehicle technology is likely to create opportunities for insurers to offer tailored coverage options, thus propelling the electric vehicle-ev-insurance market forward.

Infrastructure Development for Electric Vehicles

Infrastructure development for electric vehicles plays a crucial role in shaping the electric vehicle-ev-insurance market. The establishment of charging stations and maintenance facilities is essential for supporting the growing number of electric vehicles on the road. In the GCC, investments in charging infrastructure are increasing, with several countries planning to expand their networks significantly. This development not only facilitates electric vehicle adoption but also influences insurance providers to create products that address the specific needs of electric vehicle owners. As infrastructure improves, the perceived risks associated with electric vehicle ownership may decrease, potentially leading to more competitive insurance rates and a more robust electric vehicle-ev-insurance market.