Rising Demand for Data Storage

The increasing volume of data generated across various sectors in the GCC is driving the demand for data center-life-cycle-services market. As organizations seek to store, manage, and analyze vast amounts of information, the need for efficient data centers becomes paramount. According to recent estimates, the data storage market in the GCC is projected to grow at a CAGR of 15% over the next five years. This surge in data generation necessitates robust life-cycle services to ensure optimal performance and longevity of data centers. Companies are investing in advanced technologies and infrastructure to support this demand, which in turn fuels the growth of the data center-life-cycle-services market. Furthermore, the emphasis on data security and compliance with local regulations adds another layer of complexity, requiring specialized services to navigate these challenges.

Growing Cloud Computing Adoption

The rapid adoption of cloud computing in the GCC is significantly impacting the data center-life-cycle-services market. As businesses increasingly migrate to cloud-based solutions, the need for reliable and scalable data center services becomes essential. The cloud services market in the GCC is expected to reach $3 billion by 2025, indicating a robust growth trajectory. This shift necessitates comprehensive life-cycle services to ensure seamless integration, management, and optimization of cloud resources. Organizations require support in areas such as data migration, security, and compliance, which are critical for successful cloud adoption. As more companies embrace hybrid and multi-cloud strategies, the demand for specialized life-cycle services that can cater to these diverse environments is likely to rise, further fueling the growth of the data center-life-cycle-services market.

Regulatory and Compliance Pressures

The regulatory landscape in the GCC is evolving, placing increased pressure on organizations to comply with various data protection and privacy laws. This trend is shaping the data center-life-cycle-services market, as companies seek to ensure compliance with local regulations such as the UAE Data Protection Law and Saudi Arabia's Personal Data Protection Law. Non-compliance can result in substantial fines and reputational damage, prompting organizations to invest in life-cycle services that help navigate these complexities. The demand for services that provide risk assessments, compliance audits, and data governance frameworks is likely to grow as businesses strive to meet regulatory requirements. This focus on compliance not only protects organizations but also enhances customer trust, thereby driving the expansion of the data center-life-cycle-services market.

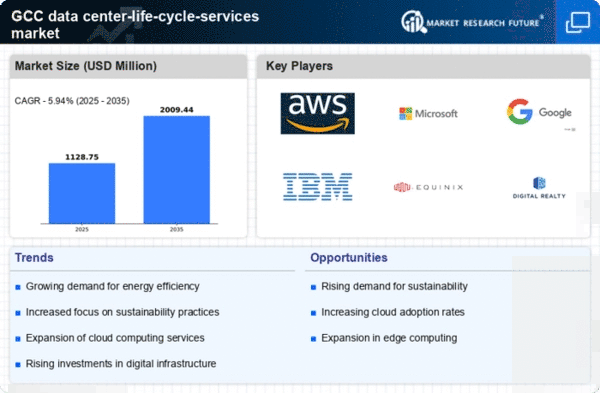

Increased Focus on Energy Efficiency

Energy efficiency has become a critical concern for data centers in the GCC, influencing the data center-life-cycle-services market. With rising energy costs and environmental regulations, organizations are prioritizing sustainable practices to reduce their carbon footprint. The GCC region is known for its high temperatures, which can lead to increased cooling costs for data centers. As a result, companies are investing in energy-efficient technologies and practices, such as advanced cooling systems and renewable energy sources. Reports suggest that energy-efficient data centers can reduce operational costs by up to 30%. This focus on sustainability not only aligns with global trends but also meets the expectations of stakeholders and customers. Consequently, the demand for life-cycle services that support energy-efficient operations is likely to grow, driving the expansion of the data center-life-cycle-services market.

Technological Advancements in Infrastructure

Technological innovations are reshaping the data center-life-cycle-services market in the GCC. The advent of cutting-edge technologies such as artificial intelligence, machine learning, and automation is enhancing operational efficiency and reducing costs. These advancements enable data centers to optimize resource allocation, improve energy efficiency, and streamline maintenance processes. For instance, predictive analytics can foresee potential failures, allowing for proactive maintenance and minimizing downtime. The GCC region is witnessing a significant investment in these technologies, with projections indicating that spending on data center infrastructure could reach $5 billion by 2026. As organizations adopt these technologies, the demand for specialized life-cycle services that can integrate and manage these innovations is likely to increase, further propelling the growth of the data center-life-cycle-services market.