Growth of Edge Computing

The proliferation of edge computing is reshaping the landscape of the data center-life-cycle-services market in Japan. As businesses seek to process data closer to the source, the demand for localized data centers is increasing. This trend is particularly evident in sectors such as manufacturing and telecommunications, where real-time data processing is essential. By 2025, the edge computing market in Japan is expected to grow significantly, potentially reaching $5 billion. This growth necessitates tailored life-cycle services that address the unique requirements of edge data centers, including site selection, deployment, and maintenance. Consequently, the data center-life-cycle-services market is likely to expand in response to this evolving demand.

Focus on Energy Efficiency

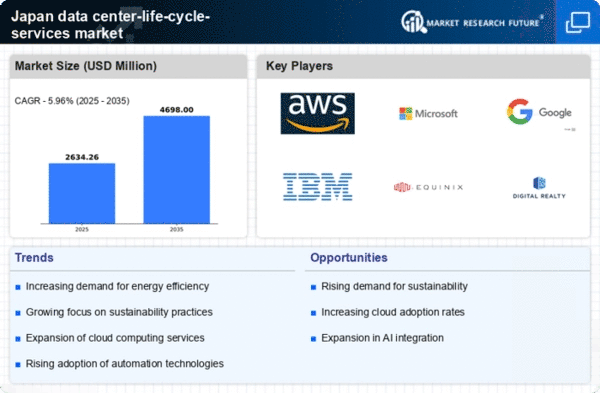

Energy efficiency has emerged as a critical concern for data centers in Japan, significantly impacting the data center-life-cycle-services market. With energy costs rising and environmental regulations tightening, organizations are increasingly investing in energy-efficient technologies and practices. The Japanese government has set ambitious targets to reduce greenhouse gas emissions, which has led to a heightened focus on sustainable data center operations. In 2025, it is estimated that energy-efficient data centers could reduce operational costs by up to 30%. This shift towards energy efficiency drives demand for specialized life-cycle services that can optimize energy consumption and enhance overall sustainability in data center operations.

Increased Cybersecurity Concerns

As cyber threats continue to escalate, the importance of robust cybersecurity measures in data centers has become increasingly apparent in Japan. The data center-life-cycle-services market is experiencing heightened demand for services that enhance security protocols and protect sensitive information. In 2025, it is projected that cybersecurity spending in Japan will exceed $10 billion, reflecting the urgency for organizations to safeguard their data assets. This trend compels data center operators to integrate advanced security solutions throughout the life cycle of their facilities, from design to decommissioning. As a result, The data center-life-cycle-services market is likely to experience a surge in offerings that focus on cybersecurity enhancements.

Rising Demand for Cloud Services

The increasing adoption of cloud computing in Japan is driving the data center-life-cycle-services market. As businesses migrate to cloud-based solutions, the need for efficient data center management becomes paramount. In 2025, the cloud services market in Japan is projected to reach approximately $20 billion, indicating a robust growth trajectory. This surge necessitates enhanced life-cycle services to ensure optimal performance, security, and scalability of data centers. Companies are seeking comprehensive solutions that encompass design, implementation, and ongoing management to support their cloud strategies. The data center-life-cycle-services market is thus positioned to benefit from this trend, as organizations prioritize reliability and efficiency in their cloud operations.

Technological Integration and Automation

The integration of advanced technologies and automation in data center operations is a key driver for the data center-life-cycle-services market in Japan. Organizations are increasingly adopting automation tools to streamline processes, reduce human error, and enhance operational efficiency. By 2025, it is anticipated that the automation market for data centers will grow substantially, potentially reaching $3 billion. This trend necessitates life-cycle services that incorporate the latest technologies, such as AI and machine learning, to optimize data center performance. As companies seek to leverage these innovations, the demand for specialized life-cycle services that facilitate technological integration is expected to rise, further propelling the market forward.