Emphasis on Safety and Compliance

The construction software market is significantly influenced by the increasing emphasis on safety and compliance regulations within the GCC region. Governments are implementing stricter safety standards to mitigate risks associated with construction activities. Consequently, construction firms are adopting software solutions that help ensure compliance with local regulations and enhance workplace safety. The market for safety management software is projected to grow by approximately 8% annually, as companies seek to reduce accidents and improve their safety records. This trend is likely to drive the adoption of specialized software tools within the construction software market.

Rising Infrastructure Investments

The construction software market is experiencing a notable surge due to increased investments in infrastructure across the GCC region. Governments are allocating substantial budgets to enhance transportation networks, utilities, and public facilities. For instance, the GCC countries are projected to invest over $1 trillion in infrastructure projects by 2030. This influx of capital is driving demand for construction software solutions that facilitate project management, resource allocation, and cost estimation. As a result, construction firms are increasingly adopting software tools to streamline operations and improve efficiency, thereby contributing to the growth of the construction software market.

Increased Focus on Cost Efficiency

The construction software market is being driven by an increased focus on cost efficiency among construction firms in the GCC. As competition intensifies, companies are seeking ways to reduce operational costs and improve profit margins. Software solutions that provide accurate cost estimation, budgeting, and financial tracking are becoming essential tools for construction managers. The market for cost management software is anticipated to grow by around 7% annually, reflecting the industry's commitment to financial prudence. This focus on cost efficiency is likely to propel the adoption of advanced software solutions within the construction software market.

Technological Advancements in Construction

The construction software market is benefiting from rapid technological advancements that are transforming the industry landscape. Innovations such as Building Information Modeling (BIM), artificial intelligence, and machine learning are being integrated into construction software solutions. These technologies enable construction firms to optimize design processes, enhance collaboration, and improve decision-making. In the GCC, the adoption of BIM is expected to increase by over 30% in the next five years, indicating a shift towards more sophisticated software tools. This trend is likely to bolster the construction software market as firms seek to leverage technology for competitive advantage.

Growing Demand for Project Management Tools

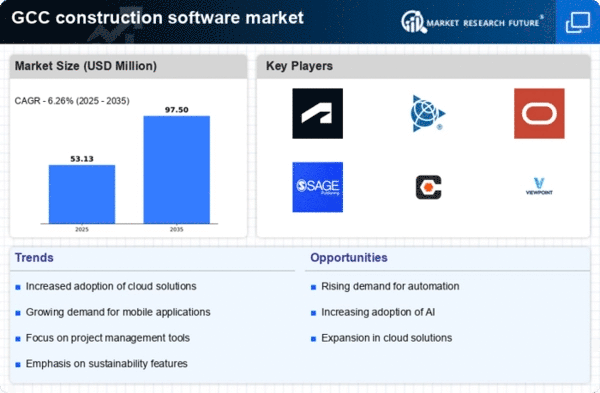

The construction software market is witnessing a heightened demand for project management tools, driven by the complexity of modern construction projects. As projects become larger and more intricate, stakeholders require robust software solutions to manage timelines, budgets, and resources effectively. In the GCC, the construction sector is expected to grow at a CAGR of approximately 6.5% from 2025 to 2030, further emphasizing the need for efficient project management. Software that offers real-time tracking, collaboration features, and data analytics is becoming essential for construction firms aiming to enhance productivity and minimize delays, thus propelling the construction software market.