Rising Demand for Cost Efficiency

The Construction Estimate Software Market Industry is experiencing a notable surge in demand for cost efficiency among construction firms. As project budgets tighten, companies are increasingly seeking software solutions that streamline estimating processes and reduce overhead costs. According to recent data, the construction sector has seen a 15% increase in the adoption of estimating software, driven by the need to enhance accuracy and minimize financial risks. This trend indicates that firms are prioritizing tools that not only provide precise estimates but also integrate seamlessly with existing project management systems. Consequently, the Construction Estimate Software Market Industry is likely to witness sustained growth as businesses recognize the value of investing in technology that optimizes resource allocation and improves overall project profitability.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are critical considerations in the Construction Estimate Software Market Industry. As governments implement stricter regulations regarding safety, environmental impact, and labor practices, construction firms must ensure that their estimates align with these requirements. Software solutions that incorporate compliance features are becoming essential for businesses aiming to mitigate risks associated with non-compliance. Recent data indicates that approximately 30% of construction projects face delays due to regulatory issues, underscoring the importance of accurate estimating tools. As firms prioritize compliance and risk management, the Construction Estimate Software Market Industry is expected to grow, driven by the demand for solutions that facilitate adherence to regulations while maintaining project efficiency.

Increased Complexity of Construction Projects

The growing complexity of construction projects is a significant driver for the Construction Estimate Software Market Industry. As projects become more intricate, involving multiple stakeholders and diverse materials, the need for sophisticated estimating tools has intensified. Construction firms are increasingly challenged to provide accurate estimates that account for various factors, including labor costs, material prices, and project timelines. This complexity has led to a heightened reliance on specialized software that can handle multifaceted calculations and provide detailed reports. Consequently, the Construction Estimate Software Market Industry is likely to expand as companies seek solutions that can simplify the estimating process and enhance project management capabilities.

Shift Towards Collaborative Project Management

The shift towards collaborative project management is influencing the Construction Estimate Software Market Industry. As construction projects increasingly involve multiple teams and stakeholders, the need for software that supports collaboration and communication has become paramount. Tools that allow for real-time sharing of estimates and project updates are gaining traction, as they enhance transparency and foster teamwork. Recent trends indicate that construction firms utilizing collaborative software experience a 20% improvement in project delivery times. This shift towards collaboration is likely to propel the Construction Estimate Software Market Industry forward, as companies seek solutions that facilitate effective communication and streamline the estimating process across various teams.

Technological Advancements in Software Solutions

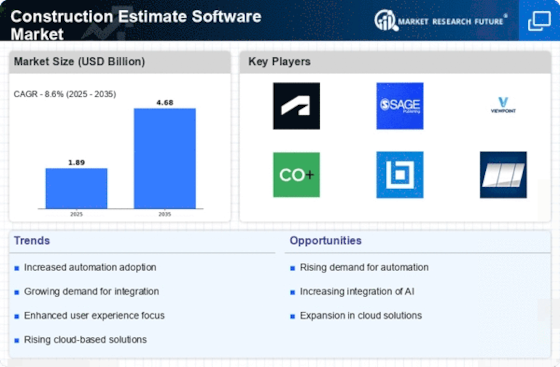

Technological advancements are significantly shaping the Construction Estimate Software Market Industry. The integration of advanced features such as real-time data analytics, mobile accessibility, and user-friendly interfaces is becoming increasingly prevalent. These innovations enable construction professionals to generate estimates more efficiently and accurately, thereby enhancing decision-making processes. Recent statistics suggest that the market for construction software is projected to grow at a compound annual growth rate of 10% over the next five years, largely attributed to these technological enhancements. As firms continue to adopt cutting-edge solutions, the Construction Estimate Software Market Industry is poised for expansion, driven by the need for improved operational efficiency and competitive advantage.