Growing Focus on Cost Efficiency

Cost efficiency is emerging as a critical driver for the AI meeting-assistants market. Businesses in the GCC are increasingly seeking solutions that can reduce operational costs while enhancing productivity. The implementation of ai meeting-assistants can lead to significant savings by minimizing the time spent on administrative tasks and improving meeting outcomes. Studies indicate that organizations can save up to 30% in operational costs by utilizing AI-driven meeting solutions. This focus on cost efficiency is prompting companies to adopt ai meeting-assistants that streamline processes and optimize resource allocation. As organizations strive to maintain competitiveness in a challenging economic environment, the demand for cost-effective meeting solutions is likely to bolster the growth of the ai meeting-assistants market.

Integration of Advanced AI Capabilities

The integration of advanced AI capabilities into meeting-assistant technologies is a significant driver for the AI meeting-assistants market. Organizations in the GCC are increasingly recognizing the potential of AI to enhance meeting efficiency and effectiveness. Features such as real-time transcription, intelligent scheduling, and automated follow-ups are becoming standard offerings. The market is expected to witness a growth rate of approximately 20% as companies invest in AI-driven solutions that can analyze meeting data and provide actionable insights. This integration not only improves user experience but also allows organizations to leverage data analytics for better decision-making. As AI technologies continue to evolve, their application in the ai meeting-assistants market is likely to expand, offering even more sophisticated functionalities to users.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are critical considerations for the AI meeting-assistants market. Organizations in the GCC are increasingly required to adhere to stringent data protection regulations, which impacts their choice of meeting solutions. The need for ai meeting-assistants that ensure compliance with local and international data protection laws is driving market growth. Companies are seeking solutions that not only enhance productivity but also safeguard sensitive information. The market is likely to expand as businesses prioritize compliance and data governance in their operational strategies. This focus on regulatory adherence is expected to shape the development of ai meeting-assistants, leading to the creation of solutions that integrate robust security features while maintaining user functionality.

Rising Demand for Remote Collaboration Tools

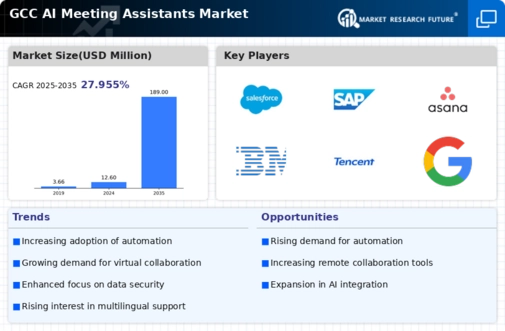

The AI meeting-assistants market is experiencing a notable surge in demand for remote collaboration tools. As organizations in the GCC region increasingly adopt hybrid work models, the need for efficient virtual meeting solutions has become paramount. According to recent data, the market for remote collaboration tools is projected to grow at a CAGR of 15% over the next five years. This trend is driving the development of advanced ai meeting-assistants that facilitate seamless communication and enhance productivity. Companies are seeking solutions that not only streamline meeting processes but also integrate with existing platforms, thereby fostering a more collaborative environment. The rising demand for these tools is likely to propel the growth of the ai meeting-assistants market, as businesses prioritize effective communication strategies in a remote work landscape.

Emphasis on User Experience and Accessibility

User experience and accessibility are becoming increasingly important in the AI meeting-assistants market. As organizations in the GCC prioritize employee satisfaction and engagement, the demand for user-friendly meeting solutions is on the rise. Companies are seeking ai meeting-assistants that offer intuitive interfaces and accessibility features, ensuring that all employees can effectively utilize the technology. This emphasis on user experience is likely to drive innovation within the market, as developers focus on creating solutions that cater to diverse user needs. Furthermore, the integration of accessibility features can enhance participation in meetings, fostering a more inclusive environment. As user experience continues to be a focal point, the ai meeting-assistants market is expected to evolve, offering more tailored solutions to meet the demands of a diverse workforce.