Focus on Enhancing Productivity

The emphasis on productivity enhancement is a key driver for the ai meeting-assistants market. In Japan, where work efficiency is highly valued, businesses are actively seeking tools that can optimize meeting processes and reduce time wastage. The ai meeting-assistants market is responding to this demand by offering solutions that automate scheduling, provide agenda management, and generate actionable meeting summaries. Recent surveys indicate that companies utilizing ai meeting assistants report a 30% increase in meeting efficiency, underscoring the potential benefits of these tools. As organizations strive to maximize output and minimize downtime, the adoption of ai meeting assistants is expected to accelerate, further propelling market growth.

Technological Advancements in AI

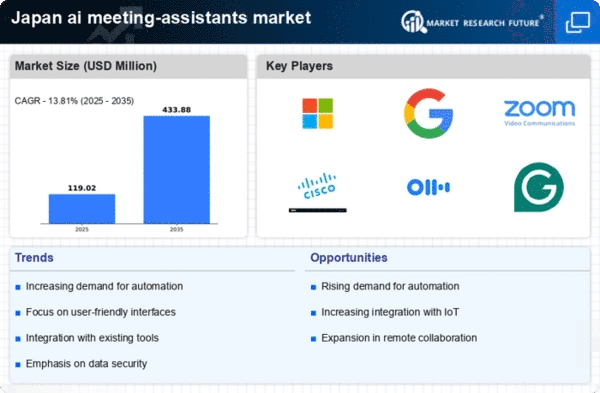

Technological advancements in artificial intelligence are significantly influencing the ai meeting-assistants market. Innovations in natural language processing, machine learning, and data analytics are enhancing the capabilities of these tools, making them more effective in understanding and responding to user needs. In Japan, the ai meeting-assistants market is witnessing a rapid evolution, with companies investing heavily in R&D to develop sophisticated features that improve user experience. For instance, the market is projected to grow at a CAGR of 15% over the next five years, driven by these technological improvements. As organizations increasingly recognize the value of advanced ai solutions, the demand for meeting assistants that can provide real-time insights and automate mundane tasks is likely to rise.

Growing Emphasis on Data Security

Data security concerns are increasingly influencing the ai meeting-assistants market. In Japan, where data privacy regulations are stringent, organizations are prioritizing secure communication tools to protect sensitive information. The ai meeting-assistants market is adapting to this need by developing solutions that incorporate robust security features, such as end-to-end encryption and compliance with local regulations. As businesses become more aware of the risks associated with data breaches, the demand for secure ai meeting assistants is likely to rise. This focus on data security not only enhances user trust but also positions the market for sustained growth as organizations seek reliable tools to facilitate their meeting processes.

Integration with Emerging Technologies

The integration of ai meeting-assistants with emerging technologies is shaping the future of the market. In Japan, the convergence of ai with IoT, cloud computing, and big data analytics is creating new opportunities for enhancing meeting experiences. The ai meeting-assistants market is witnessing a trend where these tools are becoming more interconnected, allowing for seamless data sharing and improved functionality. For example, integrating ai meeting assistants with smart devices can facilitate voice-activated commands and real-time data access during meetings. This synergy not only enhances user experience but also drives efficiency, making it a compelling factor for businesses looking to leverage technology for better collaboration.

Rising Demand for Remote Work Solutions

The shift towards remote work in Japan has catalyzed the growth of the ai meeting-assistants market. As organizations adapt to flexible work arrangements, the need for efficient virtual collaboration tools has surged. According to recent data, approximately 60% of Japanese companies have adopted remote work policies, leading to an increased reliance on digital communication platforms. This trend necessitates the integration of ai meeting-assistants to streamline scheduling, enhance productivity, and facilitate seamless interactions among team members. The ai meeting-assistants market is thus positioned to benefit from this ongoing transformation, as businesses seek innovative solutions to maintain operational efficiency in a remote work environment.