Shift Towards Digital Payment Solutions

the account payable market is shifting towards digital payment solutions, driven by the increasing preference for cashless transactions in the GCC. Businesses are increasingly adopting electronic payment methods, such as virtual cards and mobile payments, to streamline their accounts payable processes. This transition is not only enhancing transaction speed but also improving cash flow management. According to recent data, digital payment transactions in the region are anticipated to grow by 40% by 2026. As organizations prioritize efficiency and cost-effectiveness, the demand for digital payment solutions within the account payable market is likely to expand, fostering innovation and competition among service providers.

Focus on Supplier Relationship Management

The account payable market is increasingly emphasizing the importance of supplier relationship management (SRM) as organizations recognize the value of maintaining strong partnerships with their suppliers. Effective SRM strategies can lead to improved negotiation terms, better pricing, and enhanced service levels. In the GCC, companies are investing in technologies that facilitate better communication and collaboration with suppliers, which is expected to enhance overall supply chain efficiency. This focus on SRM is likely to drive growth in the account payable market, as businesses seek to leverage these relationships to optimize their financial operations and reduce costs.

Regulatory Changes and Compliance Requirements

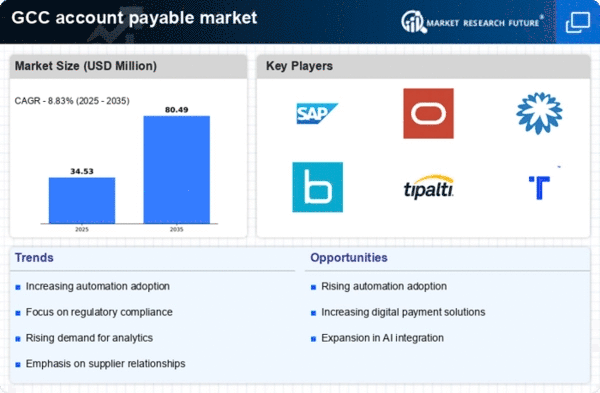

The account payable market is significantly influenced by evolving regulatory changes and compliance requirements within the GCC. Governments are implementing stricter financial regulations to enhance transparency and reduce fraud. For instance, the introduction of electronic invoicing mandates is compelling businesses to adapt their accounts payable processes. Compliance with these regulations is not merely a legal obligation; it also serves as a competitive advantage. Companies that effectively navigate these changes can minimize risks and enhance their reputations. As a result, the demand for compliance-focused solutions in the account payable market is expected to rise, with an estimated growth rate of 25% in the coming years.

Rising Demand for Real-Time Financial Insights

The account payable market is experiencing a growing demand for real-time financial insights, as organizations strive for greater visibility and control over their financial operations. Businesses in the GCC are increasingly seeking solutions that provide instant access to accounts payable data, enabling them to make informed decisions quickly. This trend is driven by the need for agility in financial management, particularly in a rapidly changing economic environment. The market for real-time analytics tools is projected to expand significantly, with an expected growth rate of 35% over the next few years. As companies prioritize data-driven decision-making, the demand for real-time insights within the account payable market is likely to increase, fostering innovation and enhancing operational efficiency.

Technological Advancements in Payment Processing

The account payable market is experiencing a notable transformation due to rapid technological advancements in payment processing systems. Innovations such as artificial intelligence and machine learning are streamlining invoice processing and approval workflows, thereby enhancing efficiency. In the GCC region, the adoption of these technologies is projected to increase by approximately 30% over the next five years. This shift not only reduces manual errors but also accelerates payment cycles, which is crucial for maintaining healthy supplier relationships. As organizations increasingly seek to optimize their financial operations, the demand for advanced payment processing solutions within the account payable market is likely to surge, driving growth and competitiveness in the industry.