Emergence of Smart Cities

The emergence of smart cities in the GCC region is significantly influencing the 5g infrastructure market. As urban areas evolve into smart ecosystems, the demand for advanced connectivity solutions intensifies. Smart city initiatives, which integrate IoT technologies, require high-speed, reliable networks to support various applications such as traffic management, public safety, and energy efficiency. The GCC governments are investing heavily in these projects, with estimates indicating that smart city investments could reach $50 billion by 2030. This trend not only drives the need for 5g infrastructure but also presents opportunities for telecom operators to collaborate with technology providers. The integration of 5g networks into smart city frameworks is likely to enhance operational efficiencies and improve the quality of life for residents.

Growing Adoption of Cloud Services

The growing adoption of cloud services in the GCC region is a pivotal driver for the 5g infrastructure market. As businesses increasingly migrate to cloud-based solutions, the demand for high-speed, low-latency networks becomes critical. The shift towards cloud computing is expected to accelerate, with projections indicating that cloud adoption in the GCC could reach 70% by 2027. This trend necessitates the deployment of advanced 5g infrastructure to support seamless connectivity and data transfer. Furthermore, the integration of 5g technology with cloud services enables enhanced capabilities such as edge computing, which can significantly improve operational efficiencies. Consequently, the 5g infrastructure market is likely to benefit from the rising need for robust networks that can accommodate the growing reliance on cloud-based applications.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity in the GCC region is a primary driver for the 5g infrastructure market. As businesses and consumers seek faster internet speeds, the need for robust 5g networks becomes evident. The GCC countries are witnessing a surge in data consumption, with mobile data traffic projected to grow by over 50% annually. This trend necessitates significant investments in 5g infrastructure to meet the escalating requirements for bandwidth and low latency. Moreover, the proliferation of smart devices and applications further amplifies this demand, compelling telecom operators to enhance their network capabilities. Consequently, the 5g infrastructure market is poised for substantial growth as stakeholders strive to provide seamless connectivity solutions that cater to the evolving needs of users.

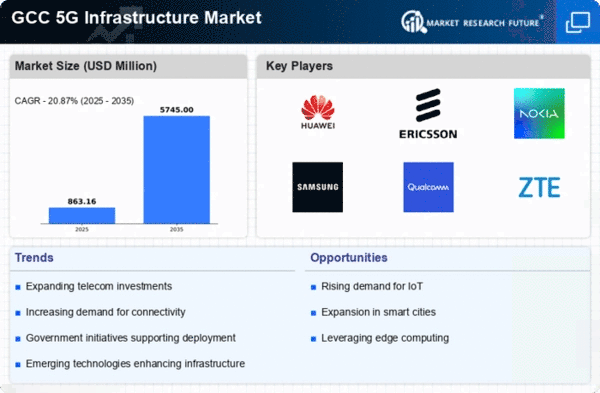

Increased Investment in Telecommunications

Increased investment in telecommunications infrastructure is a significant driver of the 5g infrastructure market in the GCC. Telecom operators are channeling substantial resources into upgrading their networks to support 5g technology. Reports indicate that the total investment in telecommunications infrastructure in the GCC is expected to surpass $15 billion by 2025. This influx of capital is directed towards enhancing network capabilities, expanding coverage, and improving service quality. Additionally, the competitive landscape among telecom providers is prompting them to innovate and differentiate their offerings, further fueling investments in 5g infrastructure. As a result, the market is likely to experience robust growth, driven by the commitment of stakeholders to deliver cutting-edge connectivity solutions.

Government Support and Regulatory Frameworks

Government support plays a crucial role in shaping the 5g infrastructure market in the GCC. Regulatory frameworks are being established to facilitate the deployment of 5g networks, ensuring that operators can efficiently roll out services. Initiatives aimed at fostering innovation and attracting foreign investments are also gaining momentum. For instance, the GCC governments have allocated substantial budgets for digital transformation projects, with estimates suggesting investments exceeding $20 billion in the telecommunications sector by 2026. This supportive environment encourages telecom companies to invest in 5g infrastructure, thereby accelerating the market's growth. Furthermore, the alignment of national strategies with global technological advancements indicates a commitment to enhancing the region's digital landscape.