Regulatory Frameworks

The Gathering Pipeline Market is significantly influenced by regulatory frameworks that govern energy production and transportation. Governments are increasingly implementing policies aimed at ensuring environmental protection and promoting sustainable practices. These regulations often require companies to invest in modern gathering pipeline technologies that minimize environmental impact. For example, stricter emissions standards and safety regulations compel operators to upgrade their infrastructure, thereby creating opportunities for growth in the gathering pipeline sector. Additionally, incentives for renewable energy projects may lead to increased demand for gathering pipelines that connect new energy sources to existing grids. This regulatory landscape indicates a dynamic market environment where compliance and innovation are key drivers of growth.

Increased Energy Demand

The Gathering Pipeline Market is experiencing a surge in demand for energy, driven by population growth and industrial expansion. As economies develop, the need for reliable energy sources intensifies, leading to increased investments in pipeline infrastructure. According to recent data, energy consumption is projected to rise by approximately 30% by 2040, necessitating enhanced gathering pipeline systems to transport oil and gas efficiently. This trend indicates a robust market for gathering pipelines, as they play a crucial role in connecting production sites to processing facilities. Furthermore, the shift towards natural gas as a cleaner alternative to coal is likely to bolster the gathering pipeline market, as more gas fields are developed and require extensive pipeline networks for distribution.

Technological Innovations

Technological advancements are reshaping the Gathering Pipeline Market, enhancing efficiency and safety in pipeline operations. Innovations such as smart sensors, automated monitoring systems, and advanced materials are being integrated into pipeline infrastructure. These technologies not only improve the reliability of gathering pipelines but also reduce operational costs. For instance, the implementation of real-time monitoring systems can detect leaks and pressure changes, minimizing environmental risks and ensuring compliance with safety regulations. The market is witnessing a shift towards digitalization, with companies investing in data analytics to optimize pipeline performance. This trend suggests that the Gathering Pipeline Market will continue to evolve, driven by the need for more efficient and sustainable energy transportation solutions.

Investment in Infrastructure

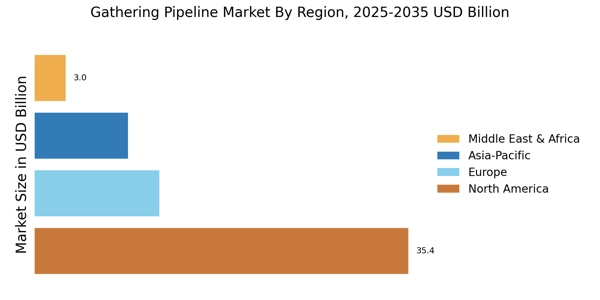

Investment in infrastructure is a critical driver for the Gathering Pipeline Market, as aging pipelines require upgrades and new projects are initiated to meet rising energy demands. Governments and private entities are allocating substantial funds to enhance pipeline networks, ensuring they can accommodate increased production levels. Recent estimates suggest that investments in pipeline infrastructure could exceed several billion dollars over the next decade, reflecting the urgency to modernize and expand gathering systems. This influx of capital is likely to stimulate job creation and technological advancements within the industry. Moreover, as energy markets evolve, the need for robust gathering pipelines becomes even more pronounced, indicating a sustained growth trajectory for the market.

Shift Towards Renewable Energy

The Gathering Pipeline Market is witnessing a notable shift towards renewable energy sources, which is reshaping the landscape of energy transportation. As countries commit to reducing carbon emissions, there is a growing emphasis on integrating renewable energy into existing infrastructure. This transition necessitates the development of gathering pipelines that can efficiently transport biogas, hydrogen, and other renewable fuels. The market is likely to see increased demand for pipelines that connect renewable energy production sites to distribution networks. Furthermore, as technological advancements make renewable energy more viable, the gathering pipeline sector may experience a transformation, adapting to new energy paradigms. This shift indicates a potential for growth and diversification within the gathering pipeline market.