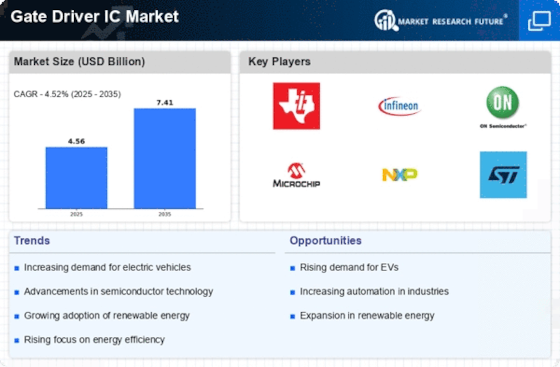

Expansion of Industrial Automation

The expansion of industrial automation is significantly influencing the Gate Driver IC Market. As industries increasingly adopt automation technologies, the demand for advanced power management solutions rises. Gate driver ICs are vital for controlling power devices in automated systems, ensuring optimal performance and reliability. The industrial automation market is projected to reach USD 300 billion by 2025, driven by the need for enhanced productivity and efficiency. This growth is likely to create substantial opportunities for gate driver IC manufacturers, thereby propelling the Gate Driver IC Market.

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency across various sectors is a key driver for the Gate Driver IC Market. Industries are under pressure to reduce energy consumption and minimize operational costs, leading to a heightened focus on power electronics. Gate driver ICs are essential for improving the efficiency of power conversion systems, which are critical in applications ranging from industrial machinery to consumer electronics. The global push for energy-efficient solutions is expected to result in a market growth rate of approximately 15% annually for power electronics, thereby positively impacting the Gate Driver IC Market.

Growth in Renewable Energy Applications

The shift towards renewable energy sources is significantly influencing the Gate Driver IC Market. As solar and wind energy installations proliferate, the need for efficient power conversion systems becomes paramount. Gate driver ICs are integral to inverters that convert direct current (DC) from renewable sources into alternating current (AC) for grid integration. The renewable energy sector is expected to witness substantial investments, with projections indicating a market size exceeding USD 1 trillion by 2030. This growth necessitates advanced gate driver solutions to optimize energy conversion, thereby driving the Gate Driver IC Market.

Increasing Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) is a pivotal driver for the Gate Driver IC Market. As automakers transition towards electrification, the demand for efficient power management solutions intensifies. Gate driver ICs play a crucial role in controlling power transistors, which are essential for the operation of EVs. According to recent data, the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This surge in EV production necessitates advanced gate driver technologies to enhance performance and efficiency, thereby propelling the Gate Driver IC Market forward.

Technological Advancements in Semiconductor Devices

Technological advancements in semiconductor devices are reshaping the Gate Driver IC Market. Innovations such as wide bandgap semiconductors, including silicon carbide (SiC) and gallium nitride (GaN), are enhancing the performance of power electronics. These materials offer superior efficiency and thermal performance, which are critical for high-power applications. The market for SiC and GaN devices is anticipated to grow significantly, with estimates suggesting a CAGR of around 30% over the next few years. This trend is likely to stimulate demand for compatible gate driver ICs, thereby propelling the Gate Driver IC Market.